The surprise Autotask-Datto merger has triggered a mostly consistent reaction from rival CEOs -- many of whom congratulated the duo on the deal, while also vowing to defeat Autotask-Datto in the SMB-centric IT service management (ITSM) technology market. And at a SolarWinds MSP conference in Orlando, attendees are very much aware of the Autotask-Datto deal -- though none were planning to make wholesale changes based on the news.

On the executive front, ChannelE2E today heard from ConnectWise CEO Arnie Bellini; Continnum CEO Michael George; eFolder CEO Matt Nachtrab; Kaseya CEO Fred Voccola; plus a range of observers at the SolarWinds MSP gathering.

Here's a sampling of views, sorted alphabetically by company name...

ConnectWise

Who: ConnectWise CEO Arnie Bellini

Portfolio: Major installed base across PSA (professional services automation), RMM (remote monitoring and management) plus sales quoting and proposal software. Growing cloud management tool, and major reseller agreements with multiple BDR (backup and disaster recovery) offerings.

Ownership: Privately held and self funded, with Arnie and David Bellini owning the bulk of the business.

Statement: “Today’s Datto/Autotask merger announcement is exactly what we expect to see in a rapidly expanding ecosystem. ConnectWise’s acquisition strategy is different. We are focused on building a completely integrated business platform for Technology Solution Providers of all kinds, including MSPs. We also believe in an open and connected ecosystem of choices. For example, ConnectWise currently offers our customers six different data protection solutions: Infrascale, Acronis, Storage Craft, Veeam, Centrestack and Storage Guardian. Those choices are important! It seems the new Datto/Autotask merger will offer a single data protection solution. That may not work out well for them. Regardless, we congratulate them and welcome the competition. It makes all of us better.”

Continuum

Who: Continuum CEO Michael George

Portfolio: Integrated platform supports RMM, BDR, NOC (network operations center) and help desk services. Major security operations center (SOC) platform under development. MSPs essentially outsource the above-stated services to Continuum in an integrated manner.

Ownership: Recently acquired by Thoma Bravo.

Statement: "Consolidation of this nature should come as no surprise to anyone in the MSP market. Standalone vendors are finding it increasingly difficult to compete as MSPs move to the few key providers that matter most to them. Today’s news should galvanize MSPs to focus on one or two key platforms, rather than trying to price-optimize with standalone independent vendors.

Today’s merger brings together two critical categories in the channel: RMM and BDR. That’s a clear signal that a unified approach to these services is in demand from MSPs, and that’s why Continuum offers partners these solutions as the cornerstone of our platform.

But, to stay relevant over the next three to five years, the next major play is security. We anticipate that the next market consolidation will come as MSPs look to acquire the tools and services to secure their clients amid today’s heightened threat landscape. That’s where we’re already moving with our new security offering launched this month, and we can expect that standalone vendors will begin to beef up their capabilities to meet that demand, and MSPs will take notice."

eFolder

Who: eFolder CEO Matt Nachtrab

Portfolio: Business continuity, data protection, file sync and sharing and more. Recently merged with Axcient.

Ownership: Private equity owned.

Statement: "Congrats to Austin and Datto on a successful sale and exit to Vista. I wish the ongoing Datto team well as they work with their new Private Equity partners. Datto has been following a strategy of expanding categories in segments that are not adjacent to their existing categories. First adding networking products and now PSA. They do, however, consistently focus on the MSP channel. Historically, I have always pursued product categories that are adjacent to the core products of the company. For less similar categories, I've leveraged partnership and resale to address the MSP channel's needs. Time will tell if their investment strategy allows them to focus enough on being really great in all categories. eFolder’s product set aligns very close to Datto’s data protection offerings historical offering, so I expect and welcome a stronger relationship with companies that compete with the now larger product catalog at Datto. That being said, we will continue to build great integrations between eFolder and the Autotask platform. I was glad to hear that they intend to continue to support an open ecosystem."

Kaseya

Who: Kaseya CEO Fred Voccola

Portfolio: RMM, PSA, cloud & networking

Ownership: Insight Venture Partners acquired Kaseya in 2013.

Statement: "The merger between Autotask and Datto signifies a major shift in the MSP vendor landscape. Investor-backed companies like Datto/Autotask and Kaseya, will continue to acquire technologies that will help them bring more comprehensive solutions to benefit the greater MSP community. On the other hand, those without the necessary financial backing (like ConnectWise, TigerPaw, and others) will steadily lose ground as they are unable to invest in the products to help take their MSPs to the next level of growth.

Kaseya will continue to work harmoniously with Datto/Autotask to deepen the integration between our products and fully support our mutual customers who use Kaseya VSA, the industry leading RMM Platform."

At SolarWinds MSP...

Meanwhile, hundreds of MSPs have gathered in Orlando at Empower MSP -- a SolarWinds MSP conference.

During a morning keynote, SolarWinds MSP Senior VP John Pagliuca remained on message and didn't specifically mention the Autotask-Datto deal.

MSPs attending the conference are very much aware of the Autotask-Datto deal. But they're not distracted by it. My best guess: Those partners are entrenched with SolarWinds' RMM offerings, while a healthy balance of partners likely run a mix of SolarWinds' BDR offerings or Datto's data protection solutions. But it didn't feel like attendees were planning to make sweeping changes based on the deal, according to background conversations this evening at a cocktail party.

On stage and off stage, the SolarWinds MSP team was relaxed and upbeat -- genuinely pleased (but not arrogant) about the company's progress with MSPs. SolarWinds MSP, Pagliuca asserted, is the world's largest IT monitoring software company. And in the MSP sector, the company serves roughly 20,000 partners, he added.

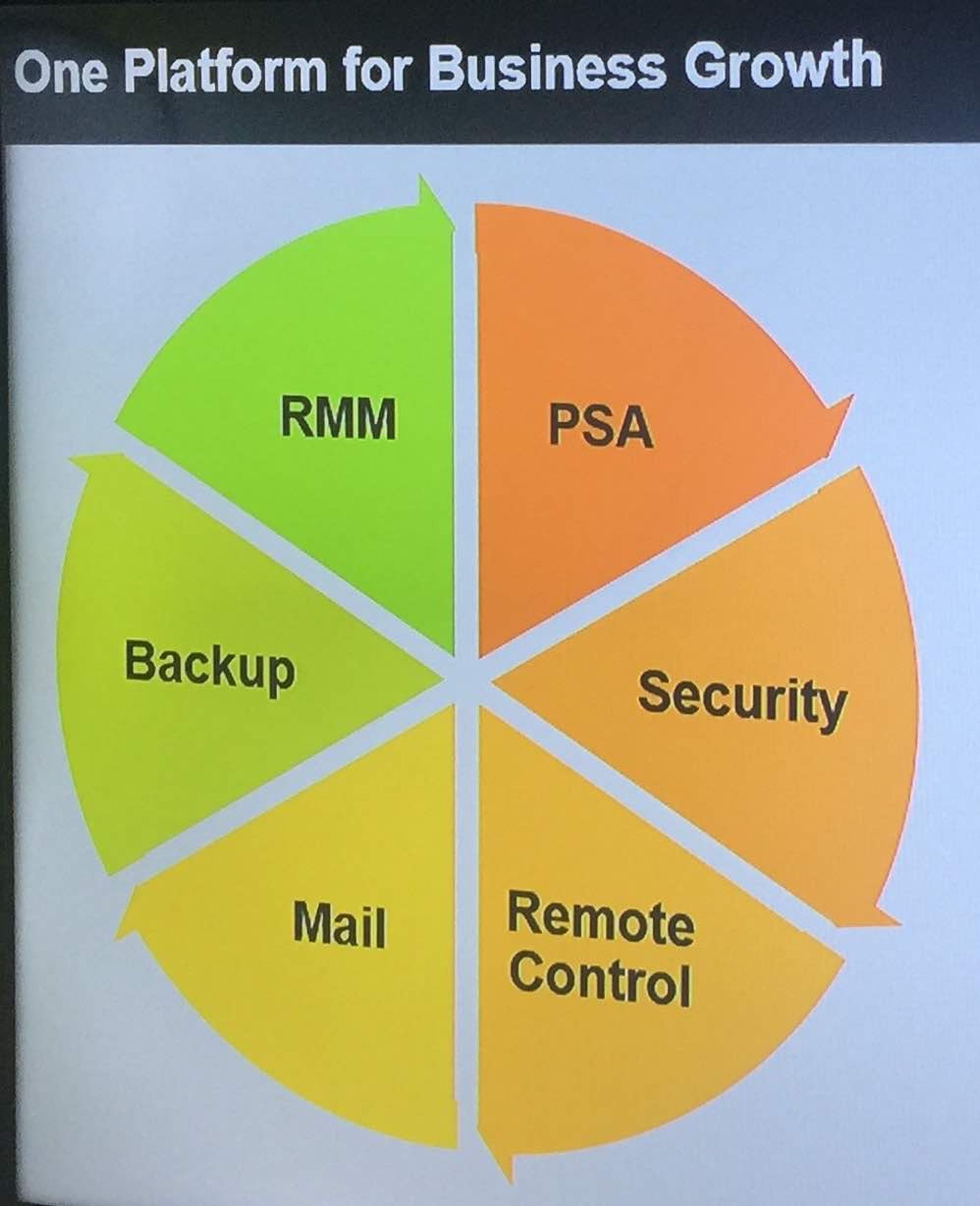

Many of the SolarWinds MSP presentation slides had familiar images that reinforced the company's established product portfolio. But some of the slides, built long before the Autotask-Datto merger, seemed especially timely again. Chief among them: The SolarWinds MSP product portfolio slide -- where offerings like PSA and backup had special relevance today.

Everybody, it seems, wants a bigger slice of the MSP platform pie...