How are U.S. small businesses holding up amid the coronavirus pandemic -- and what's the potential impact for MSPs and the broader IT channel? The short answer requires weaving together such data points as:

- Americans likely filed 2.25 million initial unemployment claims this week, Goldman Sachs forecasts. If true, that would be the highest figure on record.

- Now, consider that small businesses represent about 43.5 percent of U.S. domestic product, and it's a safe bet a huge slice of those estimated unemployment figures involve SMB employees -- and potential lost monthly recurring revenue (MRR) seats for MSPs.

- The unemployment rate could hit 20 percent if a proposed economic stimulus package is not passed, U.S. Secretary of Treasury Steven Mnuchin estimated on March 19, 2020. (The package is expected to reach a vote the week of March 23, Bloomberg Radio reports.)

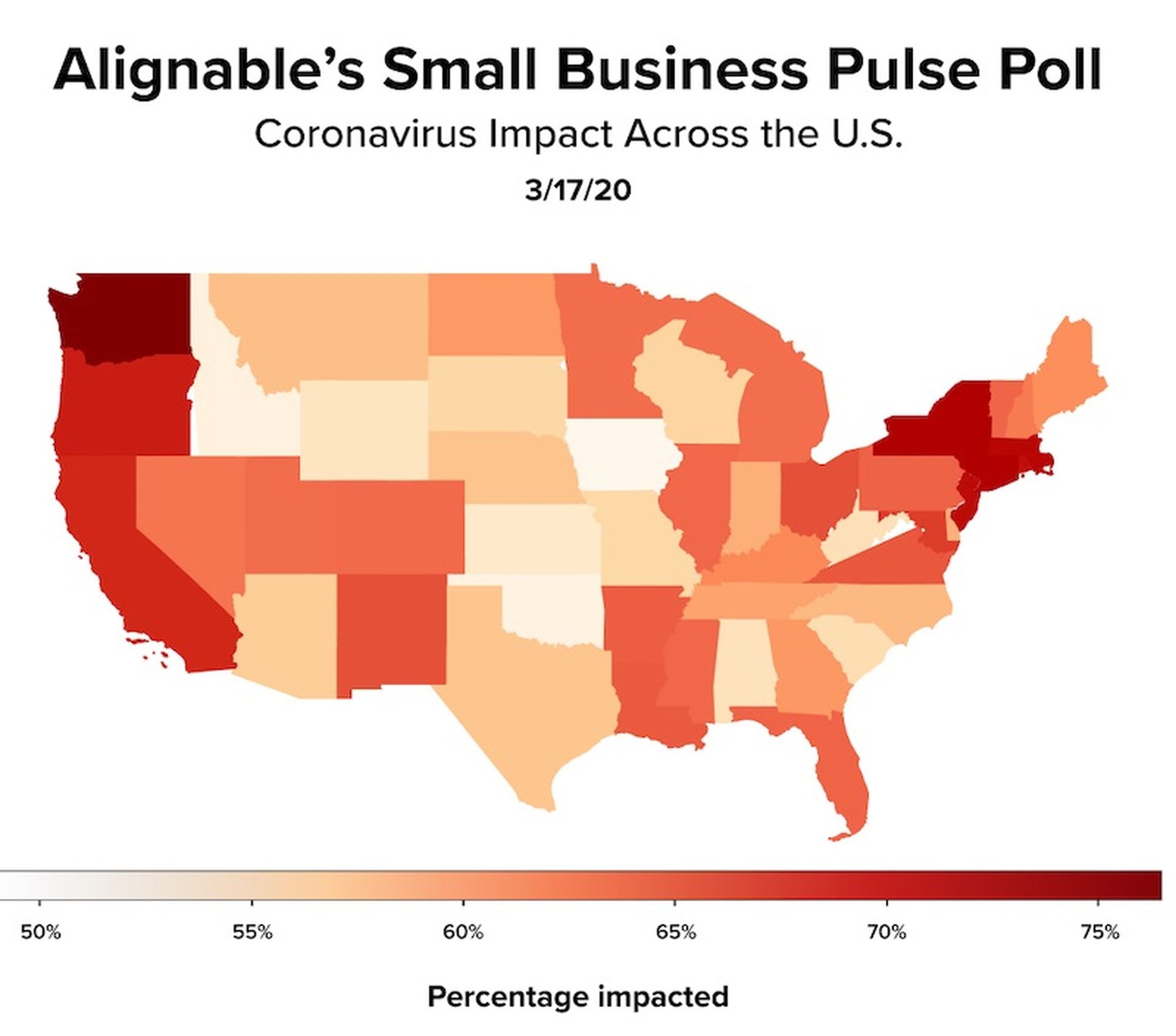

No doubt, the pandemic's impact on SMBs certainly varies by region and vertical market. But the data in some regions suggests an imminent SMB cash crunch, and the need for MSPs and channel partners to take these seven steps to protect their businesses immediately.

Small Business Cash Flow: More Data Points

Here are additional data points to help keep in mind...

1. SMBs Under Pressure: The percentage of small business owners negatively impacted by the coronavirus jumped from 60 percent to 80 percent in only a four-day period, according to Eric Groves, co-founder and CEO of Alignable, an online network for small business owners.

2. Regions Under Pressure: The six areas with the highest percentage of small businesses facing pressure include:

- Washington State (77 percent);

- New York, Connecticut, and Massachusetts (74 percent);

- New Jersey (73%); and

- California (71%).

3. Small Business Cash-Flow Challenges: Cash flow is a challenge for many small businesses even during healthy economies -- as this research points out:

- Companies with fewer than 500 employees typically have less than a month of cash reserves, according to a 2016 study by the JPMorgan Chase Institute.

- Smaller businesses often have just a couple of weeks worth of cash to keep running, that research found.

- This recent NPR story took a closer look at what those data points mean amid the current pandemic.

Early March 2020 Research Findings: Before the National Emergency

How quickly are some U.S. small business ecosystems unraveling right now? The answer is difficult to pinpoint because it has only been one week since President Trump declared a federal emergency and launched a public-privacy partnership to drive coronavirus testing nationwide.

In early March 2020 -- a week or so before Trump took high-profile public action -- research from the National Federal of Independent Business (NFIB) offered clues about the problems to come. That research found:

- As of early March, only one in four small businesses have been hurt by the coronavirus (Covid-19) pandemic, but owners expect disruptions in the next three months as the disease spreads, the (NFIB) found.

- Three percent said the crisis is having a positive effect on their outfits.

The study didn’t break down results by small businesses type so it’s unclear if MSPs are experiencing similar conditions. The statistical expectation, however, likely mirrors the larger population.

More Early March 2020 Data Points

Among small businesses in the study not seeing declines as of early March:

- 43 percent anticipate their business being impacted if the Covid-19 outbreak spreads to, or spreads more broadly, in their immediate area over the next three months.

- 20 percent do not expect to be impacted if the outbreak broadens.

- 37% aren’t sure what’s going to happen.

Of those businesses negatively impacted as of early March:

- 39 percent are experiencing supply chain disruptions.

- 42 percent have seen slower sales.

- 4 percent have employees who are ill but not necessarily with Covid-19.

Many small businesses owners are heeding the Center for Disease Control and Prevention (CDC) recommendations and making sure they’re fortified to blunt Covid-19’s disruption to their organizations as much as possible.

- 30 percent of owners have stocked up on disinfectant and hand sanitizer for their business.

- 12 percent have talked with employees about sick leave or work from home policies.

- 2 percent have modified their supply chain or changed their buyers or vendors.

- 52 percent have yet to take any special actions.

- 44 percent of small business owners are somewhat or very concerned about Covid-19’s potential impact on their business.

- 37 percent are slightly concerned.

- 18 percent are not at all concerned.

Small Business Loans and Financing: Challenges, Solutions

Anecdotal evidence, including ChannelE2E conversations with multiple MSPs, suggest the small business market is weakening considerably each day in key regions such as New York.

Ingram Micro's Kirk Robinson

Ingram Micro's Kirk RobinsonBut finding those loans isn't all that easy. The reason: Each state must seek and receive a disaster declaration from the SBA before it can start lending in that state.

Still, the are signs of progress.

- Updated March 20, 2020: The SBA has launched a coronavirus disaster loan assistance webpage to help small business owners determine if they’re located in a state that qualifies for immediate help.

- Moreover, roughly $300 billion toward helping small businesses avoid mass layoffs -- could be on the way, the Washington Post reported March 18, 2020.

Ingram Micro Assists: Meanwhile, some technology vendors and distributors are taking steps to assist partners on the financial front. Ingram Micro, for instance, has temporarily waived fees on most financial programs, according to a March 18 letter to partners from Kirk Robinson, senior VP and U.S. Chief Country Executive.

Side note: A tip of the hat to Channelnomics Founder Larry Walsh, for pointing out some of the lending challenges small businesses face as they reach out to the SBA.

MSP & Cloud Recurring Revenue Aren't Recession Proof

As New York and other states introduce regulations to keep workers home and temporarily shut down certain businesses, MSPs may quickly realize that their monthly recurring revenue (MRR) business models are not recession proof.

Amid that reality, we'll repeat our standard advice: MSPs and channel partners need to take these seven steps to protect their businesses immediately.

Additional insights from Senior Contributing Editor Doug Kass.