Still trying to understand why Rackspace (NYSE: RAX) put OpenStack on the back-burner in order to develop managed services for Microsoft Azure and Amazon Web Services (AWS)? All you need to do is look at three simple slides from Rackspace's earnings call this evening.

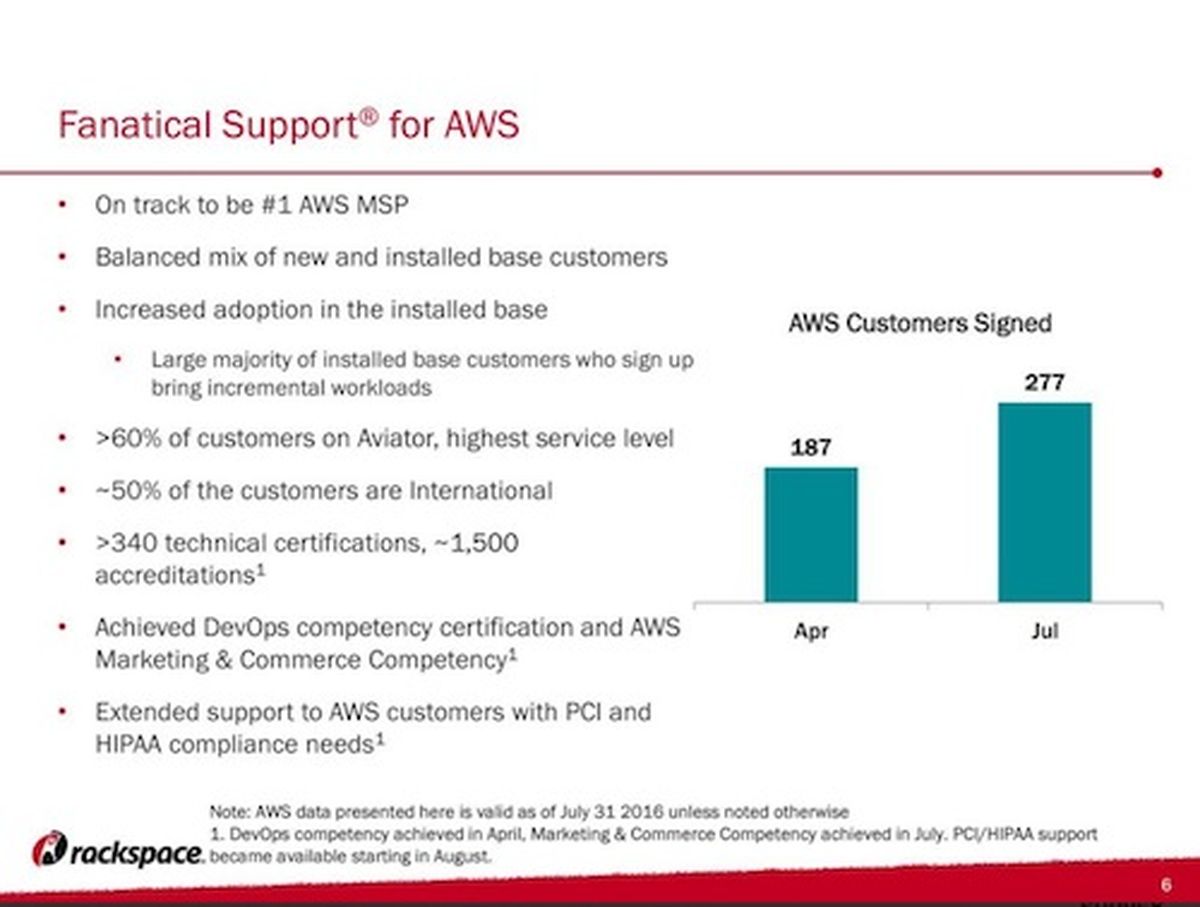

The first slide involves Rackspace's AWS momentum -- including 277 customers signed in July vs. 187 customers signed in April. The company says it's on track to become the world's top MSP serving AWS customers. That's an impressive claim, considering we're tracking more than 50 Amazon MSPs that are vying for that title.

Rackspace's AWS Momentum...

Here's that first slide on AWS momentum:

Rackspace's Azure Momentum

The second slide explains Azure momentum. The highlights include 211 customers signed in July vs. 178 in April. Fewer than 10 hosting partners worldwide are enabled for two-tier distribution across the entire Microsoft suite. Rackspace is one of them. Impressive.

Here's that second slide on Azure momentum:

OpenStack Momentum (Or Not)

Now, let's move along to the third slide, where the company describes its OpenStack private cloud momentum. Suddenly, the conversation goes from upbeat to depressing. Rackspace essentially apologizes to shareholders, stating that "complex enterprise deployments are leading to longer time to deployment." In other words, this business continues to take a lot more time to scale than originally expected. Rackspace mentions exactly two customer wins on the OpenStack slide.

Here's that third slide on OpenStack private cloud momentum:

In Rackspace's defense, the company did promote OpenStack private cloud's momentum during an earnings call this evening. CEO Taylor Rhodes noted:

"As we reported in recent quarters, demand for our OpenStack public cloud is slowing. But as expected we've seen strong demand for OpenStack private clouds. In Q2, we closed deals to deploy OpenStack private clouds for a leading automaker and for one of the world's largest IT and management consulting companies. We also saw a major expansion of our relationship with a very large customer that we landed in Q1, which is one of the world's leading industrial conglomerates. The customers for our OpenStack private cloud tend to need larger more complex solutions and these have a longer deployment and revenue materialization cycle averaging about six months."

That business should continue to grow, the company insisted, because many customers want cloud-rich capabilities delivered on-premises for years to come.

Rackspace Reality Check

Still, in three slides or less, you can understand how Rackspace went from an aspiring cloud competitor to an MSP that services other public clouds. At one time, Rackspace actually positioned OpenStack as the "Open" public cloud alternative to AWS and Azure. But the open pitch fell flat.

No doubt, plenty of businesses are growing fast by focusing on OpenStack. Key names to know include Mirantis. But in Rackspace's case, OpenStack hasn't been a savior. Instead, it demands time and resources to drive customers wins.

And as you know, Rackspace may be running out of time as a standalone company...