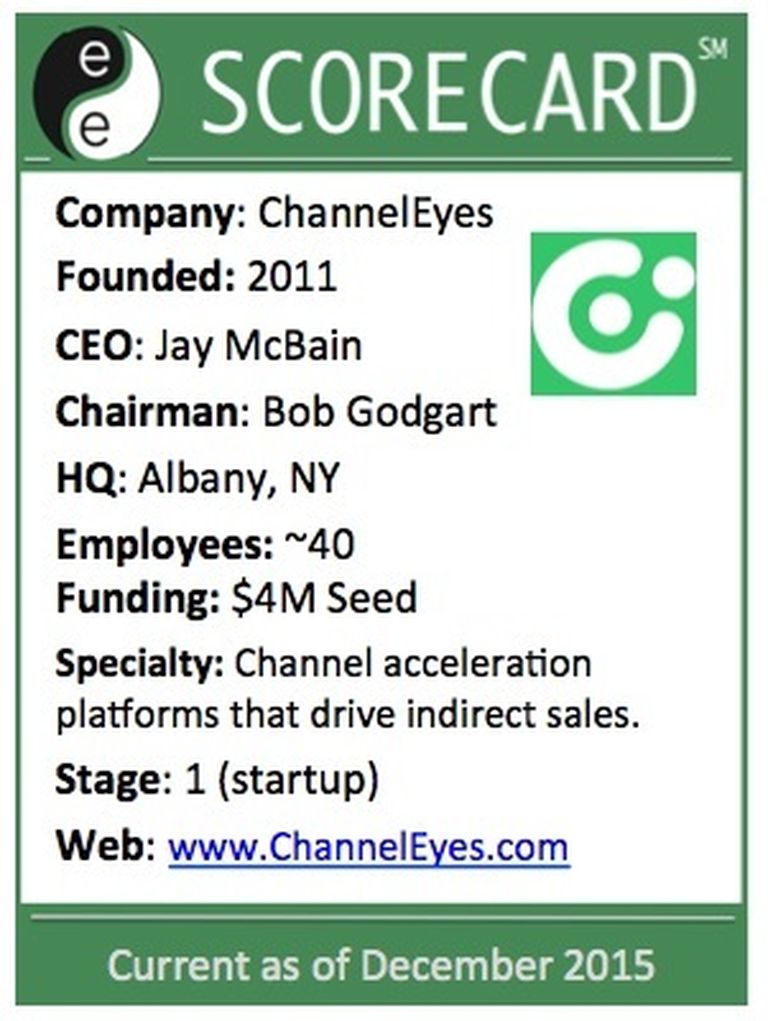

At first glance, ChannelEyes recently unveiled its most ambitious product launch to date -- Optyx, a data-driven workflow tool for channel account managers. But take a closer look and you'll see a larger strategy -- and a longer-term journey -- unfolding at the venture-backed channel startup.

That journey involves plenty of people and a growing portfolio of products and services.

- First, there's the big-picture evolution of ChannelEyes -- which has evolved beyond a social media platform to ride the mobile wave... and perhaps the data wave.

- Next, there are the products and services within that evolution -- such as ChannelCandy and Optyx.

- And don't forget the personal journey -- for first-time CEO Jay McBain, Chairman Bob Godgart, and dozens of employees.

The ChannelEyes journey started in 2011, when McBain and Godgart attempted to build a social media platform for the channel -- something akin to Facebook for vendors, VARs and MSPs. That effort didn't exactly take off. Perhaps because vendors were too busy to contribute content into the system, and channel partners had their hands full supporting customers while juggling existing digital distractions like Facebook and Twitter.

The pivot arrived in late 2012, when ChannelEyes launched ChannelCandy, a mobile app platform for vendors, distributors and associations. By mid-2013, ChannelCandy was turning heads and earning positive feedback from IT vendors. Fast forward to the present and dozens of major IT companies and startups now leverage the app and related modules to communicate with their partner ecosystems.

Game over. Time for ChannelEyes to sit back and ride the mobile wave -- right? Actually, no. ChannelEyes prefers to catch each IT wave as it's building. During the company launch, that meant social. Then came mobile. And now -- analytics and big data insights.

"If you think about our journey, this is like our third iteration as a company," says CEO Jay McBain. Gartner VP Tiffany Bova, he notes, talks about reading the tea leaves each year. And those tea leaves led from social to mobile to big data.

When the original social play didn't take off, "we were lucky to have the pivot that was put in front of us, which was mobile," says McBain. When ChannelEyes launched, about 20 percent of users had a smartphone. Today, it's about 90 percent, he estimates. "We were able to pivot toward mobile with the social network and add-ons." The result: Roughly 80 percent of partner-facing apps run on ChannelCandy, he estimates.

Viewing the Channel From a Data Perspective

McBain still attends most of the major IT channel conferences. But to learn what's really next, he had to exit traditional conversations and parachute into different types of events -- such as Dreamforce, the annual Salesforce user conference. There, he spotted the big data and analytics waves long before they reached the IT channel shores.

Then, McBain started doing some math. Roughly 75 percent of the world's trade flows through indirect channels. What if there was a way to make channel account managers (CAMs) smarter -- using data? A simple example:

What if it's raining in Chicago and there's a Bears football game on? Chances are, channel partners and target customers in Chicago are less likely to pick up their phones for cold calls during that time window -- because everyone is glued to the football game. Now, run the numbers out a bit longer, and what if you targeted regions without football games at the same time -- and you score one new deal a week by calling elsewhere?

Of course, it's a hypothetical scenario. But McBain uses it to help paint a clearer picture: Many channel account managers (CAMs) are running their territories on spreadsheets -- without any real "business intelligence" behind the decisions they make.

To fix that disconnect, ChannelEyes spent the past year building Optyx, which combines data and workflow to outline next moves and follow-through action items for CAMs.

Data Leadership... and Executive Leadership

ChannelEyes began the Optyx build-out about a year ago. At the same time, Godgart and McBain were quietly preparing for a CEO transition -- passing the CEO crown from Godgart to McBain in 2015.

On the business front, the company quietly raised about $4 million in seed money and has grown to about 40 employees -- half of whom focus on research and development (R&D). McBain also expects the company to pursue Series A funding in 2016.

On the leadership front, the 2015 CEO transition from Godgart to McBain wasn't an overnight decision. In fact, it was always part of the corporate plan. Rewind to McBain's time at IBM and Lenovo (1993-2010), and McBain was laying the foundation to someday run a technology company.

One of his key mentors is Rory Read, a former Lenovo executive who went on to run AMD before recently joining Dell to oversee the EMC integration strategy. Read always encouraged McBain to take on more and more responsibilities as part of the journey toward a CEO post.

McBain followed Read's advice. And more recently, he's followed the mentorship of Bob Godgart. The two first worked together at Autotask before co-founding ChannelEyes.

ChannelEyes: Still Ahead of the Curve?

Near term, ChannelEyes' focus is on the successful build-out of the Optyx business. McBain expects the Optyx business to surpass ChannelCandy in revenues during its very first year of activity. (Admittedly, I don't have exact revenue figures for the existing business or target goals.)

Even if Optyx is a runaway success in 2016, don't expect ChannelEyes to rest on its laurels. "Basically, it's three times in a row we've been a little ahead of the curve," says McBain, referring to the social, mobile and big data plays. To maintain that reputation for being ahead of the curve, I suspect ChannelEyes is white boarding a longer-term Internet of Things play...

But even before a "next platform" potentially emerges, McBain sees plenty of room for growth. In addition to pursuing Series A funding toward the end of 2016, he expects the company to grow from about 40 people to more than 100 employees. "From there, it's all about execution in other verticals and adjacent markets," he says.

Poke around a bit more, and you may even get McBain to mention a billion-dollar figure. Is that a long-term revenue or valuation goal? Hmmm... that's another blog, about a longer-term journey, for another time.