When it comes to leases, loans and lending, IT service providers work with a range of sources -- distributors, technology vendors, banks, credit unions and the list goes on. Of course, online lenders are a hot addition to that list. But are small business owners satisfied with the online lending experience? The answer often is no.

Indeed, small businesses are most satisfied with small banks (75 percent), followed by credit unions (56 percent) and large banks (51 percent). Satisfaction with online lenders comes in at only 15 percent, according to a 2015 Small Business Credit Survey performed by Federal Reserve Banks representing several states. The survey involved 3,459 small businesses with 500 or fewer employees -- and 74 percent of those firms had less than 10 employees. (Caveat: We don't know if the survey results are potentially biased since traditional banks ran the survey...)

When it came time to seek financing, 20 percent of employer firms applied at an online lender. While the approval rate was relatively high for applicants (71 percent were approved for at least some credit), approved firms were not very satisfied with their online lending experience, the report found.

On the one hand, small business owners seem to praise online lenders for simply application processes and rapid credit decisions. But that speed-to-decision also comes at a price, with small businesses owners expressing concern about online lending interest rates (70 percent) and unfavorable payment terms (51 percent), the survey found.

Meanwhile, 73 percent, turned to a banker or lender for advice. However, microbusiness applicants also relied heavily on Small Business Development Centers (SBDCs), friends and family, and loan brokers. More than 20 percent of microbusinesses sought advice from loan brokers compared to just 7 percent of applicant firms with more than $10 million in annual revenues, the report said.

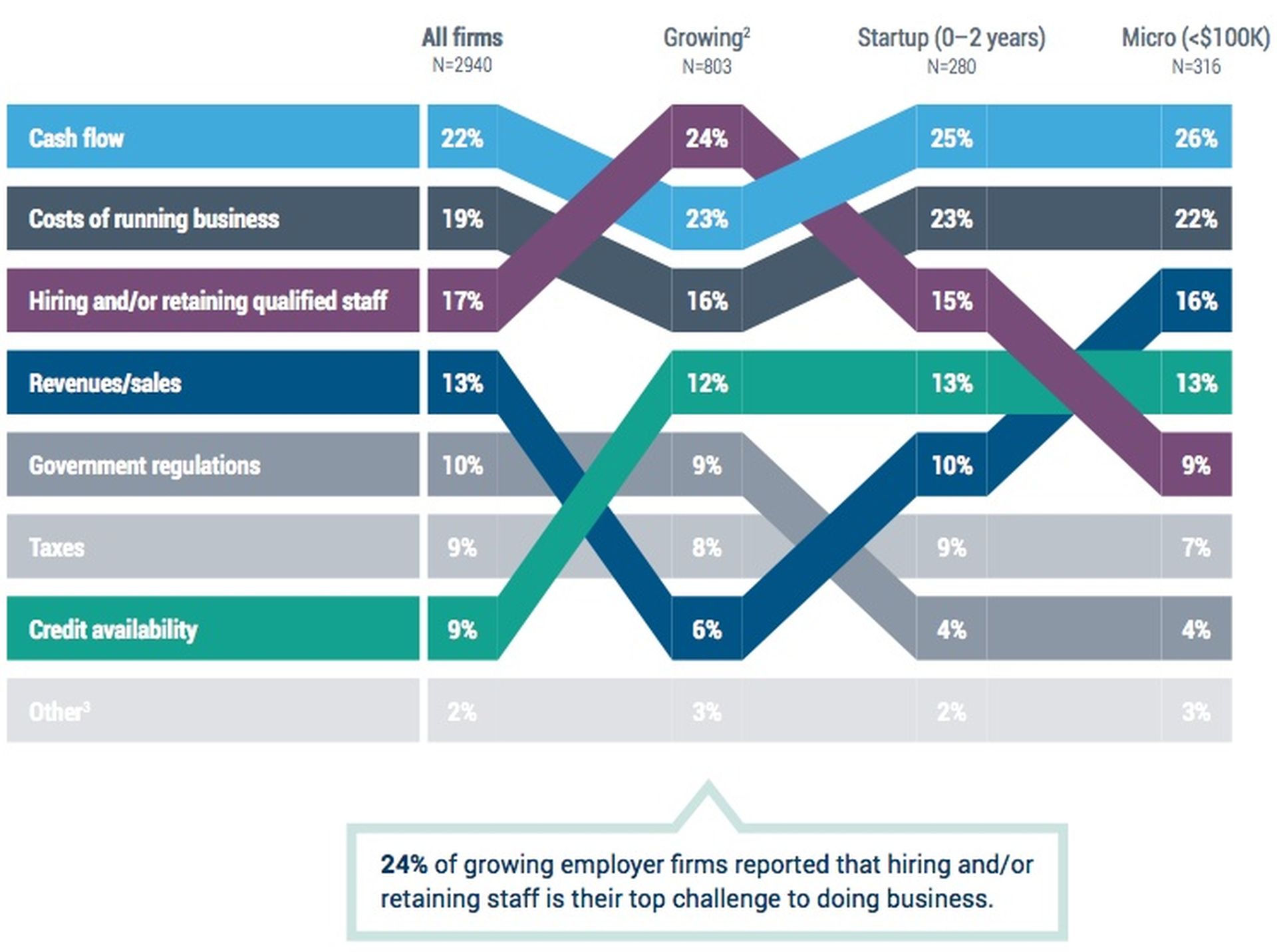

Top Small Business Challenges

Cash flow, as the chart above shows, remains the top challenge for most businesses -- except growth businesses, where finding and retain talent is now the top concern.

MSPs Enjoy Solid Financial Footing

Still, the news is good in the MSP and IT services markets, where recurring revenue models have greatly reduced cash flow concerns in recent years. ChannelE2E checked in with MSP community organizations (like HTG Peer Groups and TruMethods) and business management tool providers (BrightGauge, MSPCFO) to check the temperature on industry debt. Based on the responses we received, the financial mood within those organizations and their partner bases sounds upbeat. Within BrightGauge's MSP user base, for instance, CEO Eric Dosal isn't hearing about cash crunches, and users appear to be managing lines of credit effectively.

"I would say debt is less of a discussion today than it was in the past as the MSP recurring revenue model has helped address a lot of the bad financial habits of the past," adds Arlin Sorenson, CEO of HTG Peer Groups. "The monthly billing in advance of services has carried over to hardware for many, so the financial health of partners in general is better today than it has been historically from what I see. That doesn’t mean balance sheets are flush with cash – I seldom see that – but they aren’t worried as much about making payroll and meeting commitments because of the regular monthly billing approach."

In terms of debt to equity ratios, the common range is 0.2 to 0.8 within the peer group that HTG President Scott Scroggin facilitates. From a pure risk perspective, lower ratios (0.4 or lower) are considered better debt ratios, according to Investopia. A higher debt ratio (0.6 or higher) makes it more difficult to borrow money.