Ascend is expected to rank among the world's Top 100 Vertical Market MSPs when ChannelE2E debuts the latest annual research on April 23.

The company was formed through the 2019 combination of West Monroe Partners’ Managed Services Division and Gratia Inc. Private equity firm M/C Partners -- which has extensive MSP industry investment experience -- backed the deal.

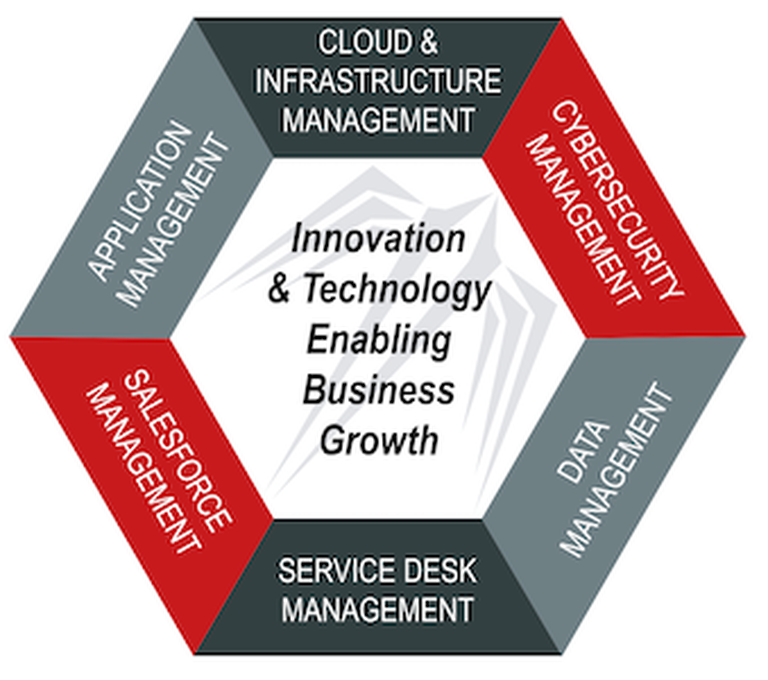

Ascend, based in Chicago, offers managed services, cloud and infrastructure, service desk, application management, and data management services. The MSP has roughly 100 technical professionals based across the Midwestern United States plus some national reach.

Ascend's Debut: Executive Perspectives

Mark Nelson, chief strategy officer, Ascend, commented:

“Bringing what has developed over the last 10 years within the Managed Services practice at West Monroe and combining it with the expertise of Gratia and backing of M/C Partners, Ascend will deepen our current solutions while expanding into new innovative services creating both organic and acquisitive growth to grow with our clients.”

Wayne Kiphart, CEO, Ascend Technologies

Wayne Kiphart, CEO, Ascend TechnologiesWayne Kiphart, CEO, Ascend, said:

“We are launching Ascend as businesses are facing extraordinary change and uncertainty. Our teams have come together at a critical time when supporting remote-workforce team collaboration while maintaining security are more crucial than ever. Not to mention, being on-call 24×7 not only to provide technical support for remote workers, but to help our clients in demanding industries redefine how to support a changing workforce. We are here to ensure operational continuity and support those on the frontlines.”

Kiphart was previously a managing partner at Gratia. Before that, he was president of OnX Managed Services and VP of managed services at Logicalis.

M/C Partners: Private Equity Investment Background

The private equity firm behind the merger has extensive experience in owning and building MSPs. M/C Partners’ previous investments include Thrive Networks, Involta, Ensono, Fusepoint, Attenda, Denovo, Carbon60, and more.

The private equity firm has invested more than $2.2 billion in capital across more than 130 companies. M/C Partners’ typically targets companies with enterprise values of $25 million to $250 million, the PE firm says.

Private equity firms have been investing heavily in MSPs, with the deals often including long-term rollups and geographic expansions to bolster scale, recurring revenue, and margin expansion.

As the coronavirus pandemic begins to wear on the global economy, it’s difficult to say whether these private equity investments will continue but PE investors are sitting on a record $1.5 trillion in cash, according to data from Preqin. That is the highest on record and more than double what it was five years ago, CNBC reports.