Amid COVID-19 economic fallout, many small businesses with 500 or fewer employees navigated the CARES Act and Paycheck Protection Program (PPP) for emergency loans and grants.

Guidance from the Small Business Administration (SBA), the U.S. federal government & banks evolved over time. And a second round of PPP funding round surfaced in early January 2021. PPP Round Two ran out of funding in May 2021. But many small businesses continue to navigate the program to understand payback terms, forgiveness application deadlines and more.

Check this blog for ongoing CARES Act and SBA updates involving:

Blog originally published Sunday, April 5, 2020. Updates are ongoing.

February 17, 2022:

- Unforgiven PPP Loans: Small businesses still face $28 billion in unforgiven loans, Bloomberg reported. That sum spans nearly 350,000 loans made to small businesses, and most of the loans are for less than $25,000. Source: American Banker, February 17, 2022.

September 10, 2021:

- SBA Loan Forgiveness Update: The SBA has forgiven — in whole or in part — more than half of the nearly 11.5 million Paycheck Protection Program loans made across 2020 and 2021. Source: The Business Journals, September 10, 2021.

September 9, 2021:

- EIDL Loan Cap Increased: The SBA has increased the COVID Economic Injury Disaster Loan (EIDL) program loan cap to $2 million. The EIDL program now also features expanded use of funds to pay and prepay business debt, streamlined review processes, and deferred payments. Moreover, the first approval and disbursement of loans of $500,000 or less has also been introduced. Source: SBA, September 9, 2021.

September 8, 2021:

- PPP Loan Forgiveness Delays: The SBA and some PPP lenders are clashing over alleged delays in loan forgiveness. The agency says some lenders are too slow. By contrast, some lenders accuse the SBA of threats. Some PPP borrowers are caught in the middle of the finger pointing. Source: Silicon Valley Business Journal, September 8, 2021.

August 17, 2021:

- PPP Loan Fraud: Roughly 15% of Paycheck Protection Program (PPP) loans could be fraudulent, new study alleges. Moreover, approximately $76 billion of the program’s $800 billion in loans may have been taken improperly, the study says. Source: The New York Times, August 17, 2021.

August 6, 2021:

- PPP Loan Forgiveness - One Bank's Move: PNC Financial Services Group, which is Pittsburgh's biggest bank, is using its own portal for PPP forgiveness applications instead of a newly launched one by the SBA. The SBA portal allows certain loan recipients to bypass their lenders. PNC Financial Services is opting out of the SBA loan forgiveness portal because the bank has "already built a streamlined end-to-end digital portal and associated review process, the bank said. Source: Pittsburgh Business Times, August 6, 2021.

July 28, 2021:

- SBA PPP Loan Forgiveness Application Website: The Small Business Administration has set up its own online, consumer-facing loan forgiveness platform. Rather than forcing borrowers to apply through banks, the SBA PPP loan forgiveness site will accept applications from small borrowers directly in a format that officials estimate will take businesses just a few minutes to go through. Lenders will still have a say in whether individual PPP loans should be forgiven, but the intent is to reduce the amount of time and effort that banks have to invest in the process. In addition, the SBA will announce plans to spare certain borrowers who received second PPP loans this year worth less than $150,000 from having to supply documentation proving that they suffered a 25 percent revenue reduction in 2020 that was required to receive the aid. Source: Politico, July 27, 2021.

July 27, 2021

- PPP Loan Forgiveness Update: The SBA on July 28, 2021, plans to outline a new initiative aimed at encouraging borrowers with loans of $150,000 or less — accounting for more than 90 percent of the pandemic-era program — to apply for loan forgiveness. The ability to convert PPP loans into grants in exchange for maintaining payroll was a critical feature of the small business rescue. Nearly 7 million of those loans have not been forgiven. Source: Politico, July 27, 2021.

July 2, 2021

- PPP Loan Forgiveness Deadline: Loan recipients have up to 10 months from the end of their "covered period" to apply for loan forgiveness before they become responsible for payments and interest. For some of program’s earliest applicants in April 2020, there was an eight-week covered period, meaning the deadline to apply for loan forgiveness would fall sometime in mid-July 2021. Later applicants operated under a 24-week covered period, meaning deadlines could come as early as September 2021. Source: Staten Island Live, July 2, 2021.

Friday, May 28, 2021:

- PPP - No New Loan Applications: The PPP program closed to new applications on Friday, May 28, as funding was on track to be exhausted. That marked the end of a $961 billion emergency effort that helped millions of small businesses survive the pandemic but was dogged by fraud claims and criticism that it didn’t reach the neediest businesses. The program had been scheduled to end on May 31, but the Small Business Administration said in a notice to lenders that “due to the high volume of originations today, the portal will be closing for new originations” on May 28. Source: The Wall Street Journal, May 29, 2021.

Thursday, May 6, 2021:

- PPP Money - Nearly All Gone: Only $8 billion remains available. Source: CBS News, April 6, 2021.

Wednesday, March 31, 2021:

- PPP Money - Gone By Mid-April?: That's the thesis from the SBA. Source: Inc., March 31, 2021.

Tuesday, March 30, 2021:

- Biden Extends PPP Deadline: President Biden, as expected, extended the PPP application deadline to May 31, 2021.

Friday, March 26, 2021:

- PPP "Hold Code" Concerns: The SBA has currently placed "hold codes" on 190,000 PPP loans. These so-called hold codes can stem from anything from typos in Social Security or taxpayer identification numbers to more serious issues. And they can be placed upon both loans that have yet to be paid out and those that are in the forgiveness process. Facing pressure from small business activists, the SBA is taking steps to clear up the hold codes. Source: Silicon Valley Business Journal, March 26, 2021.

Thursday, March 25, 2021:

- PPP Application Deadline Extended to May 2021: The U.S. Senate voted to extend the PPP program until the end of May 2021, giving small businesses more time to apply and the government more time to process requests. The National Retail Federation (NRF) and nearly 100 other business groups voiced their support of the PPP Extension Act of 2021. Sources: Reuters and the National Retail Federation, March 25, 2021.

Tuesday, March 23, 2021:

- More PPP Changes?: Some PPP loan recipients claim loan term changes came too late to help their businesses. Now, they're pushing Congress for retroactive PPP changes. Source: The Wall Street Journal, March 22, 2021.

Tuesday, March 16, 2021:

- PPP Application Deadline Extension: The House passed a bill extending the deadline for applying for a PPP loan to May 31, sending the legislation to the Senate as the current March 31 deadline looms. Source: The Wall Street Journal, March 16, 2021.

- PPP Duplicate Loan Concerns: The Small Business Administration mistakenly paid close to $692 million in duplicate PPP loans to thousands of small businesses, even as others struggled to secure enough financing to stay afloat during the pandemic, according to a new report published by the agency's in-house watchdog. Source: Fox Business, March 16, 2021.

- PPP Loan Fraud: A Washington technology executive has pleaded guilty to wire fraud and money laundering after obtaining $5.5 million in PPP loans and laundering the proceeds. Mukund Mohan of Clyde Hill submitted eight fraudulent PPP loan applications on behalf of six different companies, according to the U.S. Attorney's Office. Source: Associated Press and an NBC Affiliate, March 16, 2021.

Thursday, March 11. 2021:

- Proposed PPP Deadline Extension: Ahead of its current expiration date on March 31, the House Small Business Committee introduced legislation on March 11 to extend the Paycheck Protection Program (PPP) through the end of May, providing further relief for small businesses. Source: Business Insider, March 11, 2021.

Wednesday, March 10, 2021:

- PPP Errors & Potential Deadline Extension: Rep. Blaine Luetkemeyer said that error codes are holding up as many as 50,000 PPP loan applications and that 10,000 of those may not get be resolved by the end of March 2021. Against that backdrop, the Missouri legislator said it is “very concerning” that Small Business Administration would be forced to stop processing loans at the end of the month. Source: American Banker, March 10, 2021.

Thursday, March 4, 2021:

- PPP Update for Sole Proprietors: The latest PPP updates may appeal to sole proprietors or owners of very small businesses. The updates: An Interim Final Rule (IFR) clarifies that Schedule C filers can use gross income rather than net, as previously specified. They also released new applications for First-Draw Borrowers and Second-Draw Borrowers. Source: Forbes, March 4, 2021.

Tuesday, March 2, 2021:

- PPP Application Deadline - Part One: The current PPP program expires March 31, but small business and nonprofit groups are pushing to extend it. Source: Silicon Valley Business Journal, March 2, 2021.

- PPP Application Deadline - Part Two: On a related note, the AICPA (a major accounting association) called on Congress to extend the PPP application period by at least 60 days. Source: Journal of Accountancy, March 2, 2021.

Monday, February 22, 2021:

- PPP for Small Businesses With 20 Employees And Fewer: The Biden administration announced that the PPP program will be available only to small businesses with fewer than 20 employees during an upcoming two-week period. The special period, which is slated to start February 24, comes after PPP loans in 2020 went to some larger businesses and publicly traded companies, leading to a backlash and returns of the money. Source: MarketWatch, February 22, 2021.

Wednesday, February 10, 2021:

- SBA PPP Loan Process Fixes: The SBA has taken steps to improve the PPP loan process after an outcry from industry groups over flaws in the program (see February 3 update further below). The SBA said it would allow lenders to directly certify the eligibility of small-business borrowers for first- and second-draw loans that had received validation errors, part of a bid to speed up the process. Lenders will also be able to upload supporting documentation for small businesses that had validation errors during the forgiveness process, the agency said. Source: Silicon Valley Business Journal, February 10, 2021.

Thursday, February 4, 2021:

- PPP Round Two Stats: More than 891,000 borrowers received a total of $72.7 billion from banks and other lenders between January 11, 2021 and January 31, 2021 as part PPP round two, according to the SBA. That means roughly 26 percent of PPP round two funds authorized by Congress in December 2020 have now been allocated. Source: Newsday print edition, February 4, 2021.

Wednesday, February 3, 2021:

- CPAs Express PPP Concerns: The American Institute of CPAs (AICPA) today sent a letter to the SBA raising concerns about the challenges small businesses are facing with the the current PPP loan application system. The AICPA's letter acknowledges the important, additional checks that were put in place to address fraudulent applications. However, it adds, “these validation checks are causing tens of thousands of legitimate applications to be denied acceptance by the SBA. Lenders and loan applicants do not understand the process to resolve these declines, creating great anxiety and confusion for small business owners.” Source: AICPA, February 3, 2021.

Monday, February 1, 2021:

Intuit QuickBooks and PPP Loans: The Intuit QuickBooks business has taken several steps to assist QuickBooks customers with second PPP loan applications. Specifically, PPP Eligible QuickBooks customers can:

- apply for a second PPP loan within QuickBooks Capital’s automated PPP application experience;

- leverage business data that’s already on the QuickBooks platform;

- leverage a partnership with SBA-approved lender Cross River Bank to help additional eligible customers facilitate PPP applications directly through Cross River Bank’s platform.

Wednesday, January 27, 2021:

- SBA Loan Data & Record Keeping Problems: The SBA has found "anomalies" in 4.7 percent of the 5.2 million loans it made through August 2020. The data errors within the SBA's system has complicated efforts by some borrowers to obtain second-round loans. Source: The New York Times, January 27, 2021.

- SBA PPP Loan Portal Problems: In a letter to the acting heads of the Small Business Administration and Treasury Department, the American Bankers Association mentioned several significant issues that have arisen since the PPP re-opened in January 2021. Specifically, ABA flagged that the PPP portal does not permit lenders to upload borrower applications for second-draw loans if the borrower still has a pending forgiveness application for a first-draw loan with SBA. Lenders have also reported receiving a high number of incorrect error messages when submitting PPP loan applications for the portal, ABA said. Source: ABA Banking Journal, January 25, 2021.

- PPP Round Two Loan Totals: The Small Business Administration has approved $35 billion in Paycheck Protection Program loans since opening its loan portal on January 11, 2021, according to new agency data. That dollar figure spans 400,580 round two loans through January 24,2021. Source: Silicon Valley Business Journal, January 27, 2021.

Tuesday, January 19:

- In the program’s first week, the SBA approved around 60,000 applications from nearly 3,000 lenders. Those applications totaled $5 billion, consuming around 2 percent of the $284 billion the program has available to lend. Source: The New York Times, January 19, 2021.

- The PPP loan portal will fully open today, January 19, 2021 to all participating PPP lenders to submit first- and second-draw PPP loan applications. Source: Newtek.

Saturday, January 9:

The U.S. Small Business Administration (SBA), working with the Treasury Department, will re-open the Paycheck Protection Program the week of January 11, 2021, for new borrowers and certain existing borrowers. Details from the SBA include:

- To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13.

Additional key PPP updates, according to the SBA, include:

- PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

- PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

- The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, destination marketing organizations, among other types of organizations;

- The PPP provides greater flexibility for seasonal employees;

- Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

- Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

- Has no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

For more information on SBA’s assistance to small businesses, visit sba.gov/ppp or treasury.gov/cares.

Friday, January 8:

- PPP and Small Business Cloud Software: The new PPP legislation updates the definition of operational expenditures eligible for PPP funds to include any business software or cloud computing service facilitating business operations, product or service delivery, human resources and other expenses, according to the bill. Source: CIO Dive, January 6, 2020.

- MSP Lobbied for Outsourced IT Funding: Hats off to Jim Turner, EVP of business development at Hilltop Consultants, an Intelliteach Company. Turner lobbied for PPP funding legislation to include money for outsourced IT spending. As the Small Business Cloud Software blurb above suggests, Turner's petition apparently was heard. Source: Change.org

Thursday, January 7, 2021:

- PPP Round Two - Small Lenders Head Start: The Small Business Administration plans to give small lenders a head start with this round two program. In its first two days, the program will accept loan applications only from community lenders like Community Development Financial Institutions, which specialize in working with low-income borrowers and in areas underserved by larger lenders. Source: The New York Times, January 7, 2021.

- Second Loans Exceeding $150,000: For second loans of more than $150,000, applicants will need to provide their lender with records proving their sales have declined. Lenders will need to do a “good faith review” of those documents. Source: The New York Times, January 7, 2021.

- Second Loans Below $150,000: For smaller loans, borrowers will not need to provide their sales records as part of their application, but the SBA can request them later. Source: The New York Times, January 7, 2021.

- New SBA PPP Leader - Biden's Nomination: President-elect Joe Biden has chosen Isabel Guzman, a California economic development official, to lead the Small Business Administration. The pick is subject to approval. Source: The Wall Street Journal, January 7, 2021.

Read earlier PPP updates by visiting the next page....

Wednesday, January 6, 2021:

- PPP Deductions - IRS Guidance: The Internal Revenue Service and the Treasury Department released guidance today on claiming deductions for expenses associated with Paycheck Protection Program loans that have been forgiven. Source: Accounting Today, January 6, 2021.

Monday, January 4, 2021:

- Flushing Financial Corporation, the parent holding company for Flushing Bank, will again participate in the Paycheck Protection Program (PPP) to provide capital to small businesses within the communities it serves, the organization says. Flushing Bank will post PPP loan application details here once the latest SBA guidance surfaces.

Wednesday, December 30, 2020:

- Nav, which offers a financing platform for small businesses, has launched a new:

- Reliant Funding and Biz2Credit have partnered to secure a second round of PPP funds for its prospects and clients, using Biz2Credit's Biz2X PPP platform. For more information, or to apply for a PPP loan, visit http://ReliantPPP.com.

- Lendio plans to hire 500 employees by the end of January 2021. PrincePerelson, a Utah-based recruiting firm, is assisting the effort. Positions are available in the Salt Lake City, Utah, and Long Island, New York, regions. The new hires will assist Lendio's PPP efforts. Lendio helped to facilitate more than 100,000 PPP loan approvals to small business owners in 2020.

Sunday, December 27, 2020:

- Trump Signs Bill: President Trump signed a sweeping pandemic-aid bill on Sunday night ending a standoff with Congress and paving the way for millions of Americans to get economic relief as the coronavirus pandemic surges across the country. Source: Wall Street Journal, December 27, 2020.

- Related: The bill includes $284 billion in funds for the Paycheck Protection Program (PPP). Businesses that already received a PPP loan will be eligible to get a second one under the new terms. Some of the PPP funds will be set aside for the smallest businesses and community-based lenders. Source: The Hill, December 20, 2020.

Wednesday, December 23, 2020:

- Fewer PPP Lenders Expected: If Congress and President Trump can agree on a second round of PPP lending, small businesses should expect fewer lenders to participate in the second round of Paycheck Protection Program loans. The reason: Some lenders are suffering from 'PPP fatigue' because of the program's chaotic rollout and ever-shifting regulations earlier this year. Source: Silicon Valley Business Journal, December 23, 2020.

Tuesday, December 22, 2020:

- President Trump, in a video posted to Twitter, urged congress to adjust the bill in several ways -- including boosting per-person checks from the current level of $600 to a new level of $2,000 per person ($4,000 per couple). Democrats appear to support the proposed per-person change. But Trump's demand to cut other funds from the pending legislation could face additional hurdles. Source: USA Today, December 22, 2020.

Sunday, December 20, 2020:

Lawmakers late in the day released a long-awaited $900 billion coronavirus relief bill that is expected to be passed by Congress on Monday, December 21 and potentially signed into law by President Trump. The bill, according to this article from The Hill, includes...

- Paycheck Protection Program: Will be refueled with $284 billion in funds. Businesses that already received a PPP loan will be eligible to get a second one under the new terms. Some of the PPP funds will be set aside for the smallest businesses and community-based lenders.

- Stimulus checks: A second round of direct payments to Americans -- up to $600 per adult and per child. Also the bill will allow U.S. citizens who are in households that also include non-citizens to receive the payments.

- Unemployment benefits: Two expiring CARES Act programs -- the Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation -- were extended for 11 weeks. Also, Congress will add $300 to all weekly unemployment benefits. Workers who rely on multiple jobs and have lost income will also be eligible for a weekly $100 boost as well.

- Plus housing assistance, educating, testing and other benefits.

- Source: The Hill, December 20, 2020.

Saturday, December 19, 2020:

- Senate Minority Leader Charles Schumer (D-N.Y.) and Sen. Pat Toomey (R-Pa.) reached an agreement late this evening on language to curtail the Federal Reserve's special lending authorities, setting the stage for passage of a coronavirus relief deal and omnibus spending package and new PPP funding for small businesses as early as Sunday, December 20. Source: The Hill, December 19, 2020.

Thursday, December 17, 2020:

- Democrats and Republicans are negotiating a potential $900 billion coronavirus relief package. The proposal features $250 billion in PPP funding as part of more than $320 billion for the Small Business Administration. The emerging $900 billion deal largely hews to the outline of a $748 billion proposal unveiled by the bipartisan House Problem Solvers Caucus and Senate moderates. But an official agreement has yet to be announced. Sources: Bloomberg Radio, The Hill, December 17, 2020.

- Fully 90 percent of small businesses have spent all of their PPP funds, according to a Goldman Sachs survey. Source: CNBC, December 15, 2020.

Wednesday, November 4, 2020: Congress should pass a new economic-relief package this year, Senate Majority Leader Mitch McConnell said, as prospects for Democrats’ multitrillion-dollar stimulus bill faded along with their chances for full control of the government. McConnell says he supports aid to schools, hospitals and small businesses, but not a more sweeping Democratic proposal. Source: The Wall Street Journal, November 4, 2020.

Thursday, October 14, 2020: Wells Fargo fired more than 100 employees over alleged relief fund abuse. Source: Bloomberg, October 14, 2020.

Friday, October 9, 2020: Small business owners who took out a Paycheck Protection Program (PPP) loans of $50,000 or less will have a simpler process to follow to seek loan forgiveness, the SBA and Treasury Department said. Source: Silicon Valley Business Journal, October 8, 2020.

Tuesday, October 5, 2020:

- PPP Loans and Small Business Mergers, Acquisitions: The SBA is now allowing lenders — under certain conditions — to approve the sale or merger of companies that took Paycheck Protection Program loans. The new guidance, issued Oct. 2, means that not all mergers or acquisitions have to receive SBA approval before going forward, although borrowers and buyers still need to adhere to specific rules. The lack of guidance — and the requirement that SBA approve all deals in advance — had caused headaches for some small-business owners. Source: Silicon Valley Business Journal, October 5, 2020.

Friday, September 11, 2020: The chances of a second round of Paycheck Protection Program loans — or any small-business stimulus legislation from Congress — is beginning to fade as the U.S. presidential election approaches. Source: Silicon Valley Business Journal, September 11, 2020.

Tuesday, September 8, 2020: JPMorgan Chase is investigating the role its employees may have played in potential abuse of Paycheck Protection Program loans and other pandemic relief programs. Source: CNN, August 8, 2020.

Tuesday, September 8, 2020: Senate Republicans, after weeks of daily phone calls, are trying to finalize a smaller, second coronavirus bill that is expected to include a weekly federal unemployment payment, another round of PPP funding and more money for testing and schools, as well as liability protections against coronavirus-related lawsuits. Update: The legislation was voted down and failed to move forward. Source: The Hill, September 8, 2020.

Tuesday, September 1, 2020: Thousands of PPP loans were awarded improperly to firms that already had received a PPP loan or were barred from doing business with the federal government, a House oversight committee concluded in a report. Source: USA Today, Sept 1, 2020.

Tuesday, August 18, 2020:

- PPP and Health Care Benefits: The Small Business Administration has released updated guidance on the Paycheck Protection Program related to payment of fees to third parties as well as health care benefits. Source: ThinkAdvisor, August 17, 2020.

Saturday, August 8, 2020:

- PPP Loan Forgiveness FAQ: The Small Business Administration (SBA), in consultation with the Department of the Treasury, introduced this PPP Loan Forgiveness FAQ for small businesses.

- Deadline: The deadline to apply for a Paycheck Protection Program (PPP) loan is August 8, 2020

Tuesday, July 28, 2020:

- Potential PPP Changes: The HEALS Act, unveiled by Republicans in the U.S. Senate, includes several potential changes to the Paycheck Protection Program. Chief among them, according to Silicon Valley Business Journal:

- Automatically forgiving PPP loans under $150,000.

- Simplified forgiveness for loans between $150,000 and $2 million, stating that those borrowers are also not required to submit to the lender certain documentation but must complete the required certification and retain records for three years, and that lenders must review the application and submit it to the agency.

- $190 billion to continue to make original PPP loans and to fund a second PPP loan to eligible businesses.

- Those second PPP loans would be open to small businesses with fewer than 300 employees with at least a 50% reduction in revenue. The maximum size for a second loan would be $2 million, and small businesses would only be able to receive $10 million total across both loans.

- A $25 billion set-aside for small businesses or organizations with 10 or fewer employees and a $10 billion set-aside for loans made by community lenders, which include community financial institutions and those with assets of less than $10 billion.

- Source: Silicon Valley Business Journal, July 28, 2020.

Read earlier PPP updates by visiting the next page....

Saturday, July 25, 2020:

- PPP Loan Forgiveness Forms: Lenders can begin submitting applications for Paycheck Protection Program loan forgiveness Aug. 10. The Small Business Administration, which oversees the Covid-19 relief program, announced the update on July 23 in a document outlining procedures for the loan forgiveness process. Source: Silicon Valley Business Journal, July 24, 2020.

Friday, July 24, 2020:

- Alleged PPP Loan Fraud: Mukund Mohan, a former executive at Amazon and Microsoft, was arrested and charged by the U.S. Attorney’s Office with forging documents to fraudulently acquire more than $5.5 million in coronavirus relief funds. Source: Seattle Times, July 23, 2020.

Tuesday, July 21, 2020:

- PPP Loan Forgiveness Application Tool: Biz2Credit has launched a PPP loan forgiveness application tool to help businesses simplify the task of seeking PPP forgiveness.

Monday, July 20, 2020:

- Treasury Secretary Steven Mnuchin told lawmakers on July 17, 2020 that they should consider automatic forgiveness for many loans under the Paycheck Protection Program, the $670 billion government-backed rescue of small businesses. Source: Politico, July 17, 2020.

Monday, July 6, 2020:

- Small businesses now have until August 8 to apply for a PPP loan, according to legislation that President Trump signed into law on July 4. Source: ChannelE2E.

Thursday, July 2, 2020:

- The US House passed an extension of the $660 billion Paycheck Protection Program fewer than 24 hours after the program shut its doors, moving one step closer to reopening the cornerstone small business coronavirus relief effort. More than 4.8 million small businesses tapped more than $520 billion in potentially forgivable loans through the program. However, more than $130 billion in allocated funds remained unused at the time of the program's closure on June 30. Source: CNN, July 1, 2020.

Friday, June 26, 2020:

- The Paycheck Protection Program had more than $100 billion in funding left as of June 20, with only days remaining until the SBA stops taking new applications on June 30. Source: Bloomberg, June 25, 2020.

Monday, June 22, 2020:

- PPP Loans and Owner Salary Limits: The Small Business Administration has officially expanded the amount business owners can pay themselves and their employees and still get full forgiveness for Paycheck Protection Program Loans. But there's a catch involving owner salary limits. Owners — those with self-employment income who file a Schedule C or F form with their taxes — are instead capped at a much lower $20,833 over the 24-week period, which amounts to $868 weekly for that full span. Owners can pay themselves more, but it just won’t count toward forgiveness of the loan. Source: Silicon Valley Business Journal, June 18, 2020.

Tuesday, June 16, 2020:

- New PPP Guidance From SBA: The latest SBA guidance for receiving a PPP loan involves these three links:

- Click here to view the new Interim Final Rules.

- Click here to view the new Borrower Application.

- Click here to view the new Lender Application.

Monday, June 15, 2020:

- PPP Payback Estimation Tools: Paychex has launched a PPP Loan Forgiveness Estimator and Forgiveness Report in its cloud-based HR suite, Paychex Flex. The goal: Simplify the PPP application process for customers and provide them the accurate information needed to satisfy the new forgiveness requirements.

Sunday, June 7, 2020:

President Donald Trump on June 5 signed PPP loan forgiveness changes into law. The changes, summarized by Silicon Valley Business Journal, include these seven updates:

- PPP Spending Timeline: Extend the “covered period” under which small businesses can spend the loan proceeds from eight weeks to 24 weeks, or until December 31, 2020.

- More Staffing Flexibility: Remove the limits on loan forgiveness for small businesses that were unable to rehire employees, hire new employees or return to the same level of business activity as before the virus.

- Qualified Spending on Non-Payroll Items: Expand the 25% cap to use PPP funds on nonpayroll expenses, such as rent, mortgage interest and utilities, to 40% of the total loan. That lowers the 75% requirement for payroll expenses to 60% to get maximum forgiveness.

- Tax Credit Flexibility: Allow small businesses to take a PPP loan and also qualify for a separate, recently enacted tax credit to defer payroll taxes, currently prohibited to prevent “double dipping.”

- Longer Payback Timeline: Extend the loan terms for any unforgiven portions that need to be repaid from two years to five years, at 1% interest.

- Longer Rehire Timeline: Give small businesses more time to rehire employees or obtain forgiveness for the loan if social-distancing guidelines and health-related actions from the Centers for Disease Control and Prevention or other agencies prevented the business from operating at the same capacity as it had before March 1.

- Loan Forgiveness Changes: Extend the period for when a business can apply for loan forgiveness, from within six months to within 10 months of the last day of the covered period, before it must start making interest and principal payments. Under the new bill, PPP loan interest and payment of principal and fees will be deferred until the loan is forgiven by the lender.

Thursday, June 4, 2020:

- PPP Loan Forgiveness - Senate Approval: The Senate passed a bill on June 3 to give small businesses more flexibility in how they spend federal loans given as part of a coronavirus aid program, CNBC reports. It now heads to President Donald Trump's desk, and he's expected to sign the bill into law.

- The bill includes these changes, CNBC notes: (1) small businesses would have to spend 60% of the loan money on payroll instead of the previous 75%. (2) They could use the funds for six months, a change from two months. (3) The proposal would extend a June 30 deadline to rehire workers. (4) It would also push back the timeline for repaying loans, and allow companies that get loan forgiveness to defer payroll taxes.

Wednesday, June 3, 2020:

- PPP Loan Forgiveness - Senate Perspectives: Key Senate Republicans are throwing their support behind a bipartisan House bill that would give small businesses more time to use Paycheck Protection Program loans and let borrowers spend less of their loan proceeds on payroll, according to MarketWatch. The measure would extend the period for using loans to 24 weeks and let borrowers spend just 60%, rather than 75%, of their loan proceeds on paying workers, the report says.

Friday, May 29, 2020:

- PPP Loan Forgiveness - Pending Legislation: The U.S. House approved legislation on May 28 making it easier for small businesses and other recipients of PPP funding to qualify for forgiveness of the loans, the Journal of Accountancy reports. Here are the details.

Read earlier PPP updates by visiting the next page....

Saturday, May 24, 2020:

- Will Your PPP Loan Be Forgiven?: Fifty-four percent of small business owners with a PPP loan expect all of their expenses to be forgiven, NFIB survey results reveal. Also, 27 percent of borrowers expect at least 75% or more of loan expenses to be forgiven.

Thursday, May 21, 2020

- PPP Changes Are Likely: House and Senate lawmakers are preparing new legislation that would make it easier for the government to forgive emergency loans to small businesses impacted by the coronavirus pandemic, The Washington Post reports. The upshot: Small businesses that receive PPP loans may receive extended timeframes to spend the money on payroll -- that is, if new legislation gets formalized and approved.

Saturday, May 16, 2020

- PPP Loan Forgiveness Calculation Form: The SBA released this PPP loan forgiveness calculation form and PPP loan forgiveness application on May 15 to help small businesses ensure their loans are forgiven.

Friday, May 15, 2020

- SEC Investigates Some PPP Loans: The Securities and Exchange Commission is conducting a sweep of public companies that have received funds from loans under the Paycheck Protection Program, ThinkAdvisor reports.

- New Deadline for Returning PPP Loans: The SBA has issued a new interim final rule night opening the door for lenders to increase existing PPP loans to partnerships and seasonal employers, the Journal of Accountancy reports. In separate guidance, the SBA extended the safe harbor for returning PPP loans from May 14 to May 18.

Wednesday, May 13, 2020

- PPP-related Taxes to Keep In Mind: An IRS rule published April 30 ensures small businesses that received PPP funding can't “double dip,” Silicon Valley Business Journal reports. The rule states that small businesses that use PPP dollars toward their payroll and other covered expenses can't then deduct those amounts from their taxes, potentially offsetting some of the loan's benefits and resulting in a bigger tax bill for some, the report says.

Tuesday, May 12, 2020

- PPP Loan Forgiveness Guidance: How can you ensure your business properly uses PPP funds -- and avoids interest or financial penalties for misuse of funds? Check out this Top 10 list of PPP loan forgiveness tips from Neil Hare, president of Global Vision Communications.

Thursday, May 7, 2020:

- Deadline for Returning PPP Funds: Did your company take a PPP loan, only to discover that perhaps the business doesn't need the loan -- or doesn't truly qualify for the money? The SBA "Safe Harbor" deadline for returning PPP funds has been extended to May 14, The Journal of Accountancy notes.

- Neediest SMBs Didn't Get PPP Loans: That's according to this New York Federal Reserve study.

Wednesday, May 6, 2020

- Wells Fargo Under Investigation: Wells Fargo has received formal and informal inquiries from federal and state agencies regarding its handling of

PPP loans, the Charlotte Observer reports. The probes come after the bank, along with three other major banks, was sued for allegedly shuffling program loans to maximize the bank’s profit, the report notes. The bank denies the allegations. - PPP Arrests: Prosecutors Allege Fraud: Two New England businessmen have been charged with illegally trying to procure PPP loans totaling $544,000, Milwaukee Journal reports. The defendants claimed to have dozens of employees earning wages at four different entities when, in fact, there were no employees working for any of the businesses, report alleges.

Tuesday, May 5, 2020

- More PPP Transparency?: A group of Senate Democrats want the Small Business Administration to disclose more real-time data on who is getting loans from the agency, arguing that more oversight and transparency are necessary after Congress passed far-reaching aid in response to the coronavirus pandemic. However, Republican Sen. Marco Rubio of Florida, the chairman of the Small Business Committee, objected and effectively blocked the effort. Rubio argued that it could slow down the urgent and important work at the already over-burdened agency. Source: CNN

- Another PPP Lender to Know: Credibly is accepting PPP loan applications here.

Monday, May 4, 2020

- Newly Approved PPP Lender: Biz2Credit, a digital platform and technology company that helps small businesses access capital, is now an approved PPP funding affiliate, the company says.

- PPP Round Two Loan Totals: The SBA and associated lenders have made 2.2 million small business loans worth a combined $175 billion in round two of the PPP program. The average size loan in round two is $79,000. Lump Round One and Round Two together, and the the government has made 3.8 million loans totaling more than $500 billion, CNN reports.

- PPP Loan Investigations: SBA Inspector General Hannibal "Mike" Ware said his office has already initiated dozens of investigations involving complaints of PPP loan fraud, Politico reports.

- PPP Loans Eliminate Tax Breaks: Small business that have PPP loans forgiven will forfeit some tax breaks, according to new rules from the Internal Revenue Service (IRS), PYMNTS.com reports.

Wednesday, April 29, 2020

- Emphasizing Community Banks: To assist community lenders, the SBA from 4pm EDT until midnight only accepted loans from lending institutions with asset sizes of less than $1 billion. In other words, dollars flowed to community banks -- which typically serve small local businesses. And yes, community banks can continue to accept loan applications after this one-day, front-of-line promotion expires.

Tuesday, April 28, 2020

- SBA Investigates Large Loans: In order to ensure PPP loans are limited to eligible borrowers, the SBA is now reviewing all loans in excess of $2 million, the organization says. The move comes after several large, publicly held companies received PPP funding. Some of those companies, facing public shaming, have since announced plans to return the money.

Monday, April 27, 2020

- SBA - Second Round PPP Loan Processing: The SBA as of Monday afternoon processed more than 100,000 loan applications from more than 4,000 lenders. The second round of lending began, as expected, at 10:30 a.m. ETD. But many small businesses complained that SBA systems were once again overwhelmed by inbound inquiries.

- SBA System Challenges: The SBA's computer systems were strained on Monday amid heavy demand for Round Two loans, SBA Administrator Jovita Carranza warned twice via Twitter.

Friday, April 24, 2020

- SBA - Second Round of PPP Funding: The Small Business Administration will resume accepting PPP loan applications on Monday, April 27 at 10:30 a.m. EDT from approved lenders on behalf of any eligible borrower, the SBA says. President Trump and Congress approved this new, second round of PPP funding in recent days.

- PPP Round One Recap: The PPP supported more than 1.66 million small businesses and protected over 30 million jobs, the SBA says.

Thursday, April 23, 2020

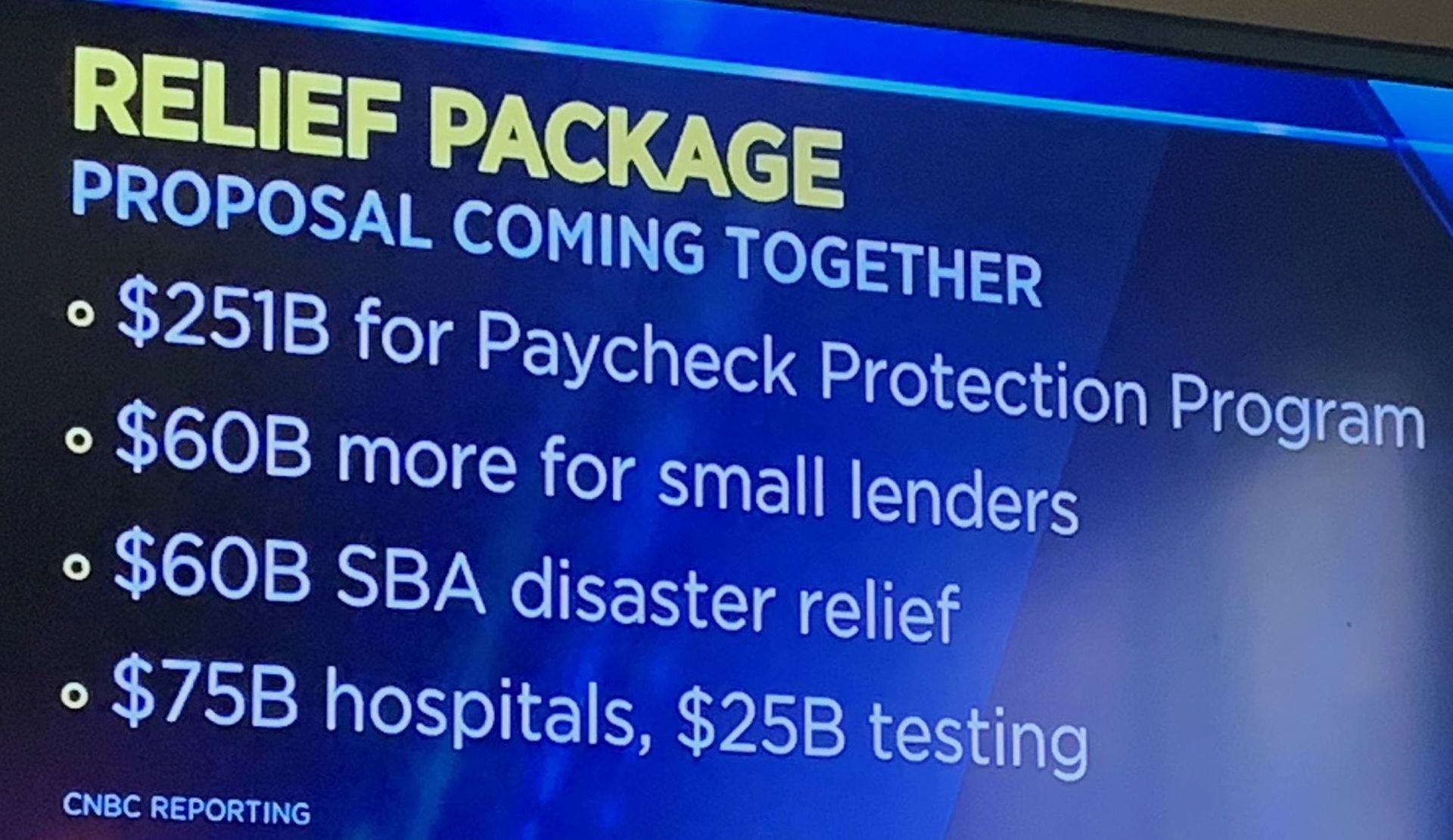

- PPP Loan Funding Round Two - House Vote: A House of Representatives vote today approved a relief package that features $310 billion for the small business loan program, $60 billion for the Small Business Administration disaster relief fund, $75 billion for hospitals, and $25 billion for testing, ABC News reports. Assuming President Trump approves the package, the SBA is expected to share details with lenders in late April or early May.

Wednesday, April 22, 2020

- How Best to Secure New PPP Funding: As the federal government prepares to replenish the PPP program, small business owners should go to Square and PayPal right now, and sign up now so that you're prepared for next round of funding, according to Bloomberg Radio.

- New PPP Funding - Big Companies Still Eligible?: The second round of PPP funding, which faces an expected House vote on April 23, still contains a loophole that allows large companies with fewer than 500 employees per location to receive funding, according to Bloomberg Radio. Republicans and Democrats are blaming each other for the ongoing loophole. House Speaker Nancy Pelosi is expected to be asked about the loophole during a midday interview on April 22.

Read earlier PPP updates by visiting the next page....

Tuesday, April 21, 2020

- PPP Funding - Second Round of Money: The Senate passed a $484 billion coronavirus relief plan, of which $251 billion will replenish the PPP program, CNBC reports. The house of representatives is expected to approve the plan by Thursday, April 23. Once President Trump signs on, the Small Business Administration (SBA) should equip banks with the new PPP loan process by late April or early May. Channel Partners seeking money from the plan should reach out immediately to small business lenders and community banks to see if they intend to support this latest round of lending. Among the tips to note: Regional banks and community banks were often more responsive than big banks during the first round of PPP inquiries, ChannelE2E believes.

Monday, April 20, 2020

- PPP Funding Update: Democratic leaders and the Trump administration are close to a deal to replenish the PPP program, multiple reports say. An official deal could arrive sometime between Monday and Wednesday, Bloomberg Radio reports.

- Shake Shack returned a $10 million PPP loan amid criticism that larger, decentralized companies with more than 500 employees participated in the SBA loan program.

- Lawsuit vs. Wells Fargo: A lawsuit alleges Wells Fargo unfairly shuffled Paycheck Protection Program applications, USA Today reports.

Friday, April 17, 2020:

- More PPP Funding?: The Trump Administration and Congress are still negotiating terms to potentially replenish the PPP program.

Thursday, April 16, 2020:

- Capital One - No PPP So Far: As PPP funds dwindle, Capital One is still not accepting applications, Washington Business Journal reports. As a result, Capital One customers are already starting to defect, the report says.

Wednesday, April 15, 2020:

- SBA PPP - Out of Money?: The PPP program is expected to run out of money later Wednesday, The Wall Street Journal reports. Negotiations between Congress and the White House resumed Wednesday over replenishing the program. As of Wednesday morning, the Small Business Administration said it had approved about 1.3 million applications, totaling more than $289 billion in loans, the report says.

- Beneficial State Bank is supporting PPP applicants in Oregon, Washington, and California. The bank has been awarded SBA approval for nearly 230 PPP applications worth $76.5 million, with 400 in-process from current and new customers collectively seeking more than of $100 million in loans, the bank says.

- SBA Lending Gateway: In response to the significant operational challenges banks experienced accessing the SBA’s systems to make PPP loans, the SBA launched a new Lender Gateway in partnership with Amazon Web Services to facilitate connection to the E-Tran system. The Lender Gateway has been used to process more than 20,000 loans, SBA Administrator Jovita Carranz tweeted on April 14.

- Wells Fargo PPP: After some early struggles, Wells Fargo seems to be making a newfound commitment to the PPP program. During an April 14 earnings call, CEO Charlie Scharf said the bank and lender has expanded its participation in the PPP program. "We're quickly ramping up our processing capacity to respond to the significant demand we've seen," he asserted. Through April 10, Wells Fargo has received more than 370,000 indications of PPP interest from customers. The bank "working with industry groups and the US Treasury in preparation to distribute millions of economic impact payments to Americans as quickly as possible," he added. Still, Wells Fargo's overall PPP efforts have faced challenges and criticisms -- as outlined in the earlier ChannelE2E updates below.

Monday, April 13, 2020

- Square and PPP: Square Capital is the latest FinTech company approved to offer PPP loans. Find details here.

Sunday, April 12, 2020

- Intuit and PPP: Intuit Financing (better known as QuickBooks Capital) is now a non-bank SBA-approved lender for PPP. Find details here.

Saturday, April 11, 2020

- PPP -- How to Avoid Misuse of Funds: What if the government investigates how you acquired and used PPP funds? Here's how to stay in the right side of the law, according to former government prosecutors.

- Additional PPP Funding Stalls: A Trump administration request for quick approval of $250 billion in additional PPP loans stalled on April 9 in the Senate after Republicans and Democrats clashed over what should be included in the latest round of government relief, The New York Times reports.

Friday, April 10, 2020

- Citigroup has started accepting PPP applications, the banking giant confirmed on April 9.

- SBA Official Criticizes Big Banks: An SMBA official from Nevada chastised big banks, accusing them of purposefully slowing down a program to lend to small businesses hurt by the coronavirus, Business Insider reports.

- PayPal now supports PPP loans to merchants that use PayPal's platforms in the U.S.

Thursday, April 9, 2020:

- Acronis and Lendio: The duo is partnering to help MSPs and channel partners access money more quickly from various sources -- including the CARES Act and PPP program. Check the Acronis website for details on April 1, 2020.

- Kabbage is accepting PPP applications. This makes Kabbage the first online-only lender to officially accept PPP applications, CrossingBoard reports.

- Silicon Valley Bank & Startups: The tech-focused bank had processed close to 5,000 applications to the SBA’s Paycheck Protection Program April 7, The Information reports. But as many as 30 percent of those ran into issues requiring applicants to restart the process, the report said.

- Federal Reserve Vows $2.3 Trillion In New Assistance: The U.S. Federal Reserve unveiled programs on April 9 that will provide $2.3 trillion in loans for small and midsize businesses, U.S. cities and states. The announcement is in addition to the established SBA PPP program, ChannelE2E believes. Stay tuned for more updates on this.

- Idaho Loans: bankcda has secured $17 million in loan funds for over 160 small businesses through the PPP. These funds will preserve over 2,100 local jobs in North Idaho and the surrounding region, the banks ays.

Wednesday, April 8, 2020:

- JPMorgan Chase and Bank of America: They've received a combined 625,000 requests for $80 billion in PPP loans, CNBC reports.

- Wells Fargo Gets Green Light: The Federal Reserve said Wednesday that it will “temporarily and narrowly modify” the asset cap on Wells Fargo so the bank can lend more under the SBA Paycheck Protection Program, the Silicon Valley Business Journal reports.

- PPP - $71 Billion Allocated So Far: Over 71B has been disbursed, according to the federal government.

- Lending to New Customers: Republic Bank, based in Philadelphia, may be the only bank in the region that is taking PPP applications from both customers and non-customers, The Philadelphia Inquirer reports.

- Update - More PPP Funding: As expected, Treasury Secretary Steve Mnuchin has requested Congress to approve $250 billion in more funding for the PPP program. Also, Senate Majority Leader Mitch McConnell said that he will work with Minority Leader Chuck Schumer to approve additional funding by voice vote or unanimous consent.

- Community Bank Lending -- Topped Out: Heartland Financial USA, a consortium of 11 community banks in 114 locations, is currently processing approximately $1.5 billion in Paycheck Protection Program loans. The Heartland consortium received over 7,000 requests for loans under the CARES Act Paycheck Protection Program in 72 hours. Heartland stopped accepting new requests for the program on April 6. Heartland serves 83 communities in Iowa, Illinois, Wisconsin, New Mexico, Arizona, Montana, Colorado, Minnesota, Kansas, Missouri, Texas and California.

Tuesday, April 7, 2020:

- More PPP Funding: If or when the PPP program needs more funding, U.S. Treasury Secretary Steven Mnuchin says he will go back to Congress and seek those dollars, Mnuchin reiterated on FOX news.

- Wells Fargo PPP Limit Pressures Small Businesses: Wells Fargo can only lend $10 billion to small businesses seeking PPP loans, San Jose Business News reports. That's only a small slice of the PPP program's $350 billion asset pool. The $10 billion asset cap is in place following Wells Fargo's fake-accounts scandal under former management. Ironically, the $10 billion cap now threatens to harm thousands of small businesses that are desperate for loans -- but may not be able to get the money through Wells Fargo. Amid that pain, the Federal Reserve may ease the asset cap on Wells Fargo, the New York Times reported on April 6.

- PPP Loan System Outage: The SBA's loan processing platform -- known as E-Tran -- went down April 6 for as long as four hours, temporarily halting the ability of lenders to process loans for small business owners seeking relief from the impact of the coronavirus, Bloomberg reports.

Monday, April 6, 2020:

- PPP Loan Calculator: Granite Creek Capital Partners and Theron Technology Solutions have launched free web-based tools for small businesses to estimate amounts available and forgiven under the Paycheck Protection Program (PPP).

- Bank of America has received applications from 177,000 small businesses for a total of $32.6 billion in financing -- or roughly one-tenth of the PPP's overall lending budget, CNBC reports.

Saturday, April 4, 2020:

- More Banks Support CARES Act, PPP Loans: In a 24-hour period, the SBA reactivated 30,000 licenses for community banks and credit unions of all sizes to get money to small businesses, SBA Administrator Jovita Carranz tweeted.

- Faith-based organizations are eligible for the PPP program and the Economic Injury Disaster Loan program, SBA Administrator Jovita Carranza says.

- Private Equity & Venture Capital Debate: The Treasury Department issued new guidance aimed at expanding access to the emergency small-business lending program, but some in Silicon Valley say it falls short of ensuring Venture Capital- and Private Equity-backed startups will be able to get aid, The Wall Street Journal reports.

Friday, April 3, 2020: Launch Day for SBA PPP Loans

- Bumpy Start: The PPP program launches but many small business owners seeking loans are greeted by confusion. The reason: Many banks are still working to understand program details from the SBA. Still, the federal government and banks assure small businesses that the issues will be ironed out. Roughly $350 billion will eventually flow through SMBs through the program, the SBA says.

- Day One Milestones: During the program's first day, more than 1,100 lenders made loans to small businesses, SBA Administrator Jovita Carranza says.

- Bank of America in Day One of the PPP program worked with more than 85,000 customers that applied for $22.2 billion in loans.

- As of mid-afternoon Friday, among the largest U.S. lenders, only Bank of America and JPMorgan Chase were accepting applications for the program, CNBC reported.

Thursday, April 2, 2020 - One Day Before SBA Launches PPP Loans

- What If PPP Loans Run Out?: Don't panic. Once the PPP loan pool dries up, U.S. Treasury Secretary Steven Mnuchin says he will go back to Congress and seek more funding for the program.

- PPP Launch Concerns: Major banks -- such as JPMorgan Chase -- tell The Wall Street Journal and CNBC that they are not adequately prepared to support the PPP program when it launches on April 3. However, the banks -- including JPM -- say they plan to support the program once they receive more information from the SBA. JPM actually wound up delivering support on Day One (April 3).

- Private Equity and Venture Capital Debate: SEC chairman Jay Clayton on April 2 said he would promote the idea that small businesses backed by private equity should be eligible for CARE Act loans, The Wall Street Journal reported. It's unclear if Clayton's efforts will empower such small businesses. Also, the House Speaker Nancy Pelosi and House Minority Leader Kevin McCarthy, who rarely agree on anything except for the grandeur of California, both want the so-called "affiliation rules" waived to empower PE-owned small businesses for the loans, Axios says.

More: Complete Coronavirus Pandemic Business & Technology News & Analysis