Snowflake's IPO (initial public offering) arrived September 16. $SNOW shares more than doubled to $245 -- putting a $67.9 billion valuation on the cloud platform provider for data management.

Here are 10 things for partners, customers and potential investors to know.

1. Snowflake Stock Symbol: SNOW.

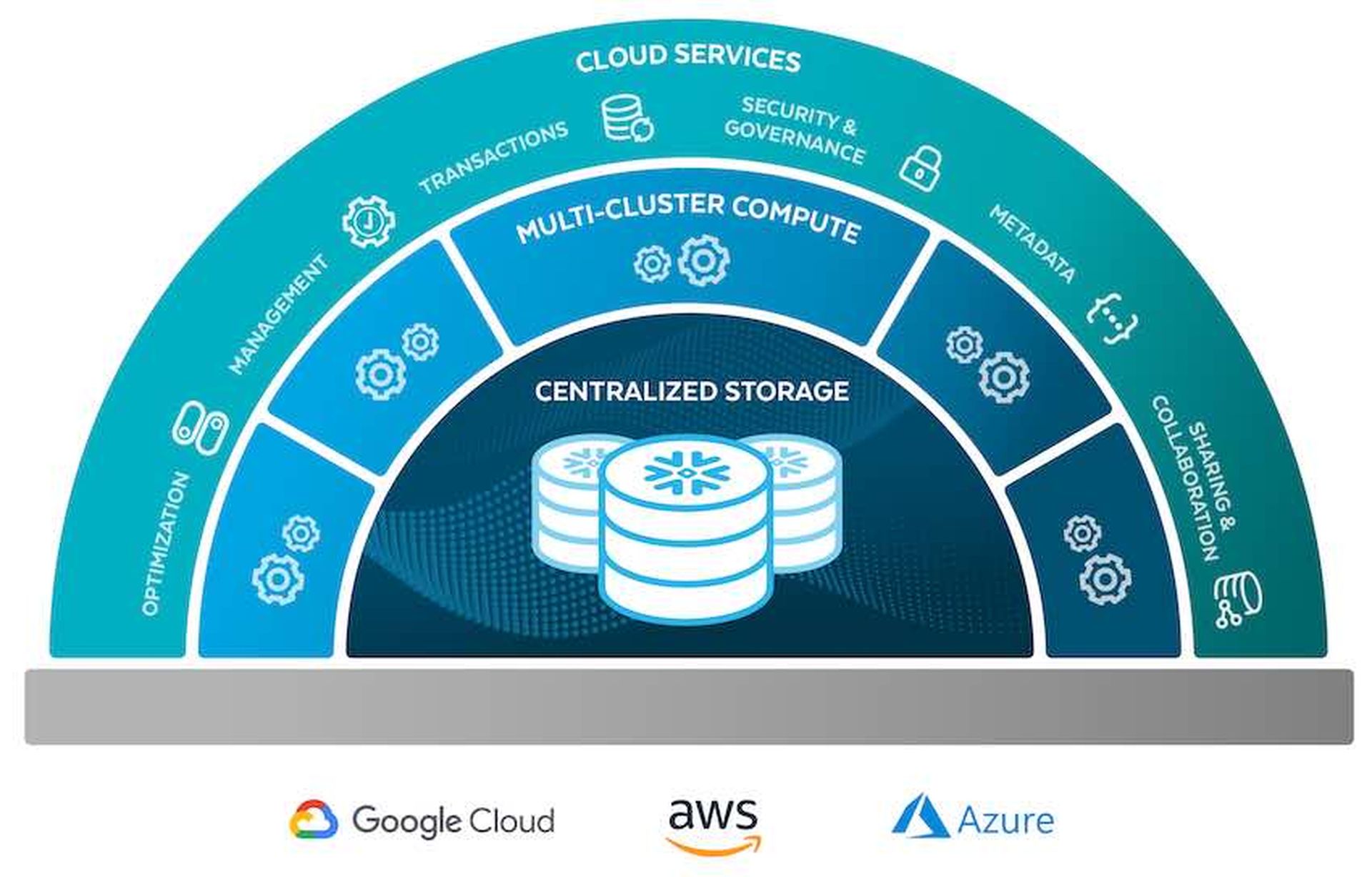

2. What Snowflake Does: "Our platform enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data. We deliver our platform through a customer-centric, consumption-based business model, only charging customers for the resources they use."

The company introduced data warehousing on its platform in 2014 as the core use case. In recent years, customers have begun using Snowflake for data pipelines, data lakes, data application development, and data sharing and exchange, the company says.

3. Valuation: Snowflake's valuation was expected to top $30 billion -- or more than twice the $12.4 billion valuation Snowflake achieved in a private funding round earlier this year, The Wall Street Journal notes. On opening day, that valuation surged to nearly $70 billion.

4. Quarterly Revenue: $133 million in Q2 of fiscal 2021, up 121 percent from $60 million in Q2 of fiscal 2020, an SEC filing says.

5. Net Loss: For the six months ended July 31, 2020, Snowflake lost $171.2 million -- slightly better than a $177.2 million net loss during the first six months of the previous fiscal year, the SEC filing says.

6. Customers: Roughly 56 customers each spend more than $1 million annually with Snowflake. The company's overall revenue base spans 3,117 customers, up from 1,547 customers in mid-2019, the SEC filing says.

7. Executive Leadership: CEO Frank Slootman previously led ServiceNow and Data Domain Inc. through their respective IPOs, The Wall Street Journal notes.

8. Snowflake Partner Program: The Snowflake Partner Network is a global program that manages business relationships with channel partners, system integrators, and technology partners. In particular, the SEC filing notes:

- System integrator partners help make the adoption and migration of Snowflake easier by providing implementations, value-added professional services, managed services, and resale services.

- Technology partners provide strategic value to customers by providing software tools, such as data loading, business intelligence, machine learning, data governance, and security, to augment the capabilities of Snowflake.

9. Technology Architecture: Snowflake's architecture is outlined in the company supplied chart below...

10. Business Risks: The company has experienced net losses in each quarter since launch, and the firm "may not achieve or sustain profitability in the future," an SEC filing said. Moreover, the company runs on Amazon Web Services, Microsoft Azure and Google Cloud Platform (GCP) -- and is therefore dependent on public cloud price negotiations.