Carbonite's acquisition of Webroot, announced February 7, aims to create a leader in endpoint data protection and security. It also aims to disrupt eight technology rivals, according to a Carbonite-Webroot financial presentation to Wall Street analysts and investors.

Indeed, Carbonite and Webroot together will seek to become the world's leading "data protection company" -- focusing intensely on a "secure and recover" strategy. The combined company expects to generate about $468 million to $482 million in fiscal year 2019 GAAP revenue.

Carbonite and Webroot Target Eight Rivals

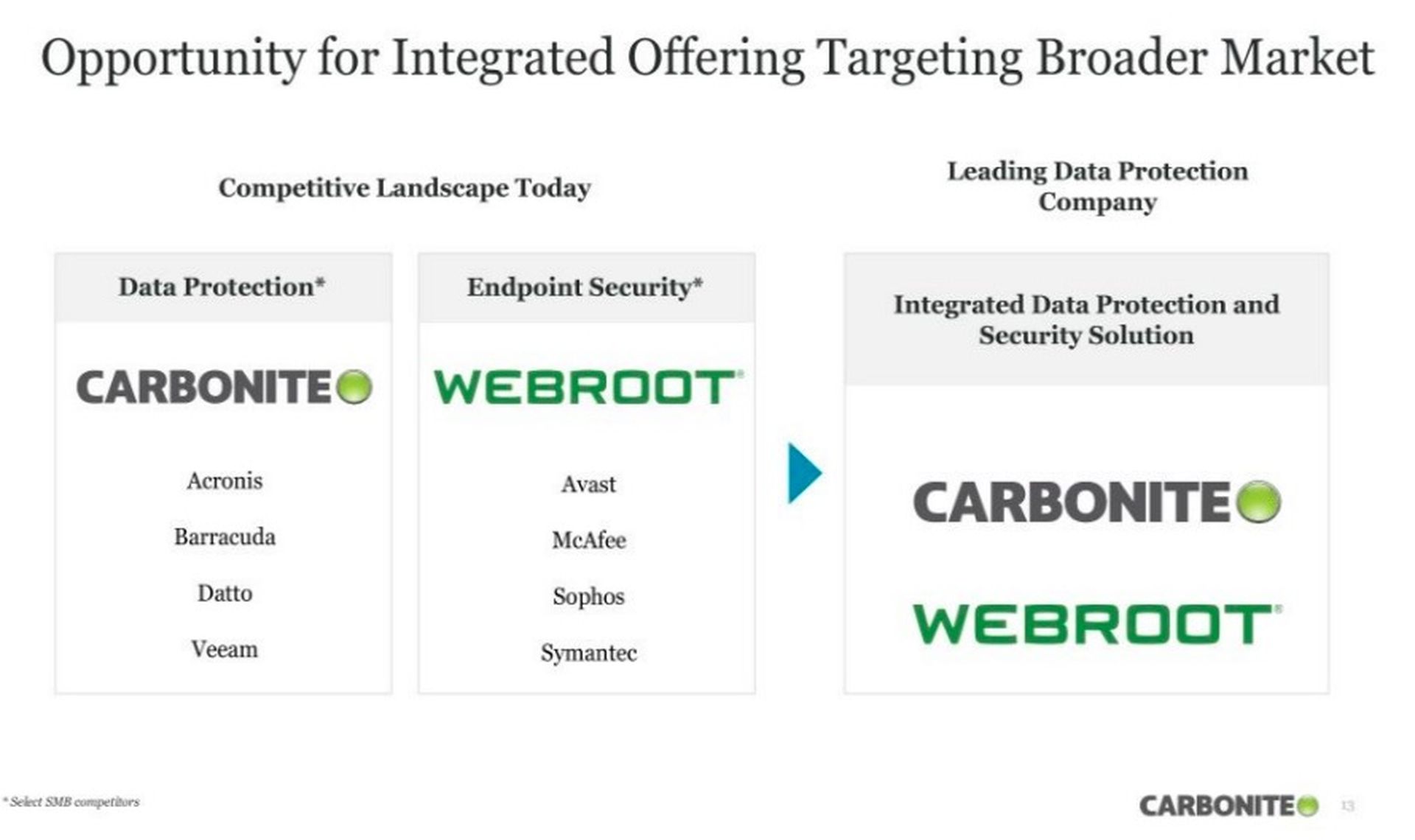

Along the way, they aim to disrupt a competitive landscape that includes these core eight rivals, according to Carbonite's financial presentation:

The Carbonite slide below summarizes the company's market view:

Much of the battle will occur in the SMB-centric MSP (managed IT services provider) partner market, where Datto and Sophos have extremely strong MSP relationships. Barracuda also has strong MSP relationships. Veeam and Acronis must also be taken seriously in that sector. McAfee and Symantec have been in evolution mode (for the past decade, come to think of it). Avast is the MSP partner wildcard on the list, though the company does have a new relationship with Barracuda.

Barracuda-Avast: Preemptive Strike vs. Carbonite-Webroot

Ironically (and perhaps intuitively) Barracuda just last week partnered with Avast. The background? We wonder if Barracuda was bidding to acquire Webroot, lost out, and partnered up with Avast as an alternative strategy against the just-announced Carbonite-Webroot combination.

I suspect Barracuda knew someone was about to acquire Webroot before Carbonite announced the deal on February 7. Indeed, Carbonite CEO Mohamad Ali confirmed during a February 7 earnings call that other companies had bid for Webroot -- though he didn't reveal the bidders' corporate names.

Carbonite and MSPs: The Long Road

Carbonite has spent nearly a decade trying to build or buy its way into the MSP partner ecosystem. The effort has yielded mixed results. The company has acquired Dell’s EMC Mozy, Data Castle, EVault and Double Take Software. The EVault deal, in particular, was supposed to generate momentum with midmarket MSPs.

No doubt, Carbonite had the beginnings of an MSP channel. But Webroot (backed by 14,000 MSPs) has true credibility in the market.

Still, the Carbonite-Webroot combination faces formidable competition. And it will likely drive some third parties to work even more closely together. A few safe bets:

- Sophos, Datto and MSPs: Watch for Sophos (security) and Datto (data protection) to double-down on MSP partner opportunities together.

- Sophos, Veeam and Midmarket Partners: Also, watch for a potential Sophos (security) and Veeam (data protection) relationship to blossom among midmarket customers and partners.

The partnerships above are just my hunches. But they're strong, logical hunches.

Déjà vu: Data Protection and Security Converge Again

Carbonite is trying to position the Webroot business combination as revolutionary. There's certainly potential upside here for both companies and their partners. But in reality, the line between BDR (backup and disaster recovery) and security in the MSP sector has been fading away since at least 2016, as ChannelE2E has previously reported.

And don't forget Symantec and Veritas tried a similar security-data protection merger strategy (on a much larger scale) more than a decade. That deal yielded miserable results, and the companies ultimately got divorced.

It's a safe bet Carbonite and Webroot won't repeat the Symantec-Veritas "merger of equal" mistakes. Carbonite CEO Mohamad Ali is firmly in control of this deal, and his track record proves he's a sharp business leader.

Plus, Carbonite has signed certain Webroot executives to retention deals, according to an SEC filing. Ideally, that means an MSP-friendly focus will remain intact. But we'll be watching to see if that remains the case.