CA recently conducted an extensive survey with 451 Research that examined how enterprises are faring with IT service management (ITSM) within today’s hybrid cloud environments. In our previous article, we offered an introduction to the survey, describing the survey’s objectives, approach and value. In this article, we’ll highlight some of the key findings from the survey. This article will provide CSPs with insights into significant market demand for premium monitoring services and the opportunities that await those businesses that start to deliver these services.

Market Demand

While there can be significant variance in terms of the approaches enterprises have been taking, there’s broad consensus on one thing: these approaches are lacking.

The majority of respondents are relying on a mix of tools, including services from service providers and internally sourced products. Employing these approaches, 42 percent of decision makers indicate they struggle with managing new, cloud-based environments. In addition, 47 percent say they have limited human capacity to monitor the full IT estate.

These shortcomings in capabilities are having broad-based implications for respondents, with a significant percentage wrestling with many pain points. The survey inquired about 28 pain points, and all of them were being felt by at least 34 percent of respondents. Following are some key themes that emerged from these responses.

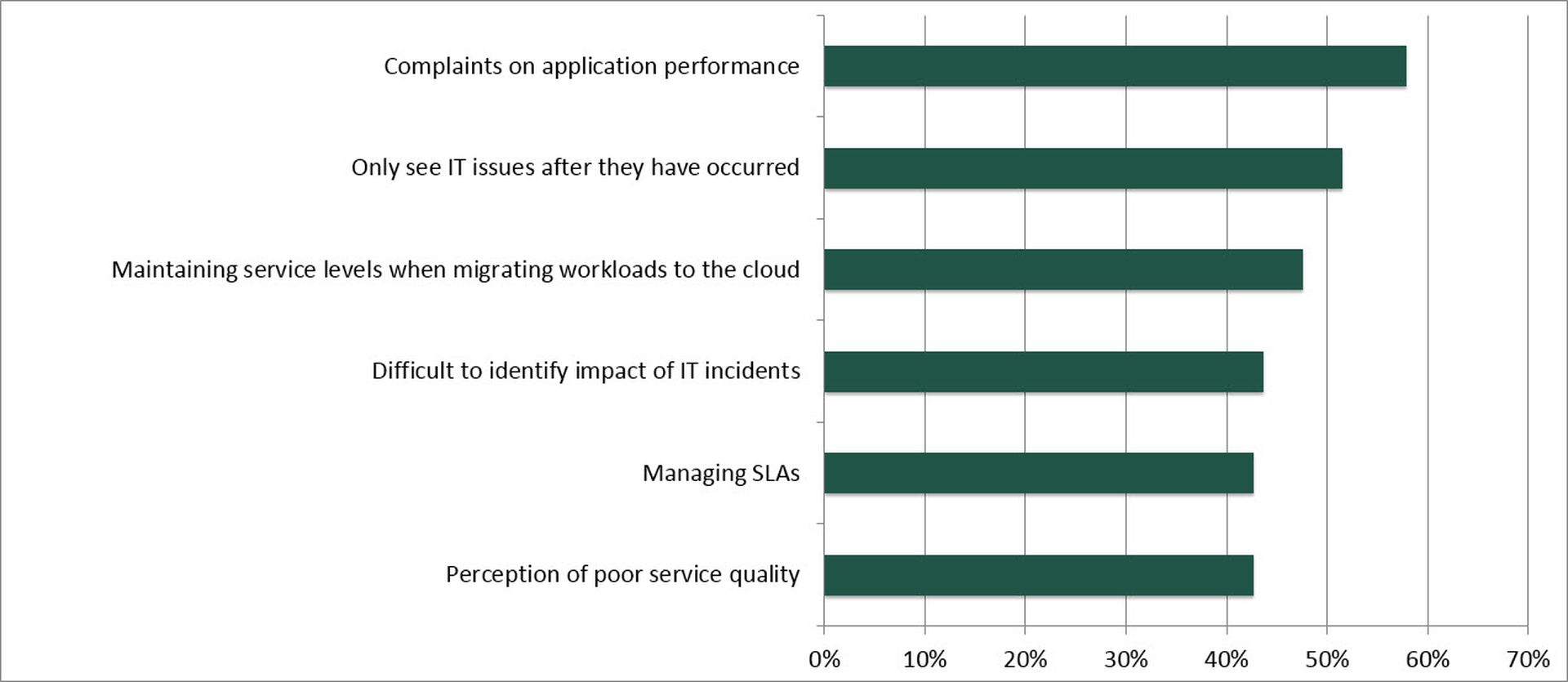

Service levels suffering

Perhaps the most significant area of pain for respondents relates to suboptimal service levels. The top-rated response across all pain points was “Complaints on app performance,” which was selected by 58 percent. “Only see IT issues after they occurred” was the fourth highest rated. Several other pain points also relate to service level issues, with the following all receiving significant responses: “Perception of poor service quality,” “Maintaining service levels when migrating workloads to the cloud,” “Managing SLAs” and “Difficult to identify impact of IT incidents.”

In today’s environment, these obstacles pose significant business challenges. Businesses are operating in an application economy, an environment in which customer perceptions and interactions are increasingly shaped by applications. When poor application performance has a direct impact on business performance, these are issues that are vital for teams to address.

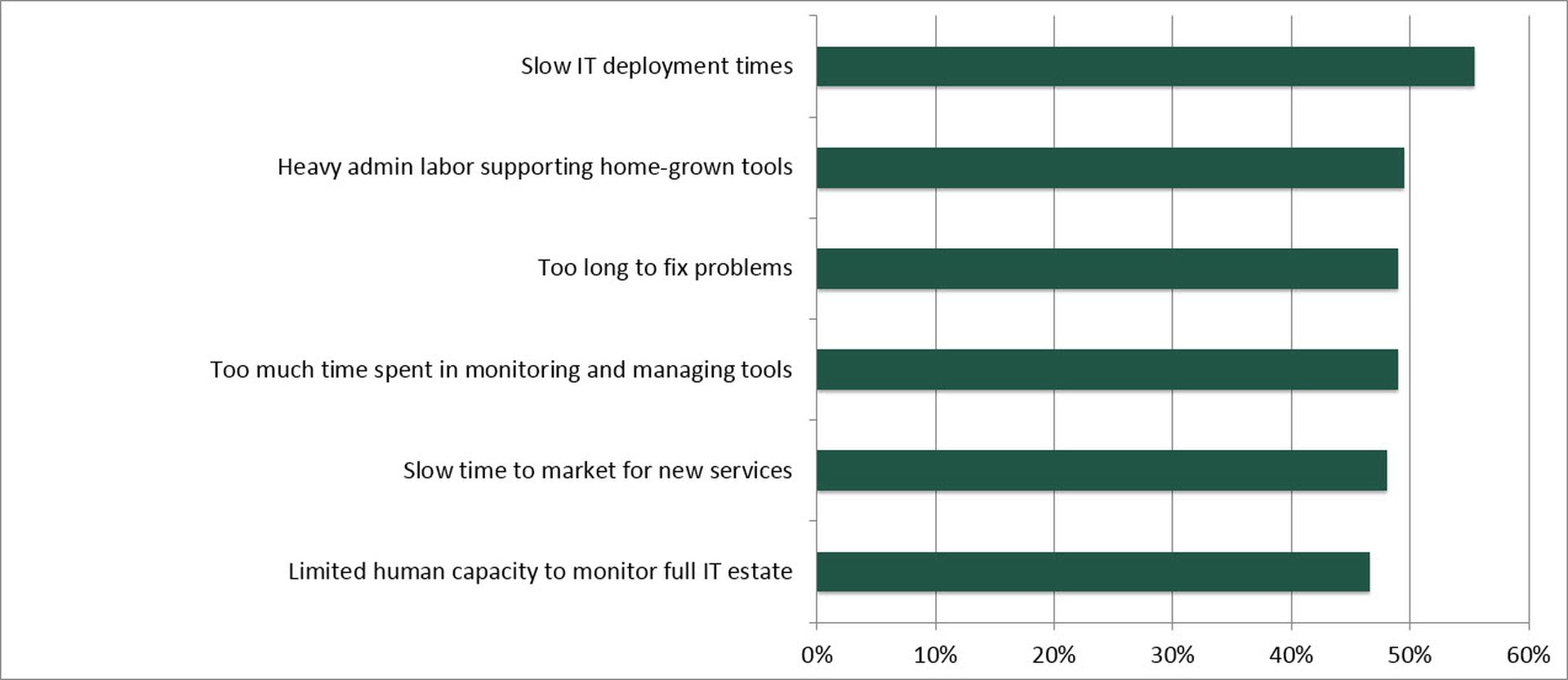

Slow, labor-intensive effort

Another theme that has a clear business impact relates to the laborious, slow processes associated with supporting internal tools, particularly home-grown code and multiple point solutions. The following areas all received significant percentages of responses: “Slow IT deployment times,” “Slow time to market for new services,” “Heavy administrative labor supporting home-grown tools,” “Too much time spent in monitoring and managing tools,” “Too long to fix problems” and “Limited human capacity to monitor full IT estate.”

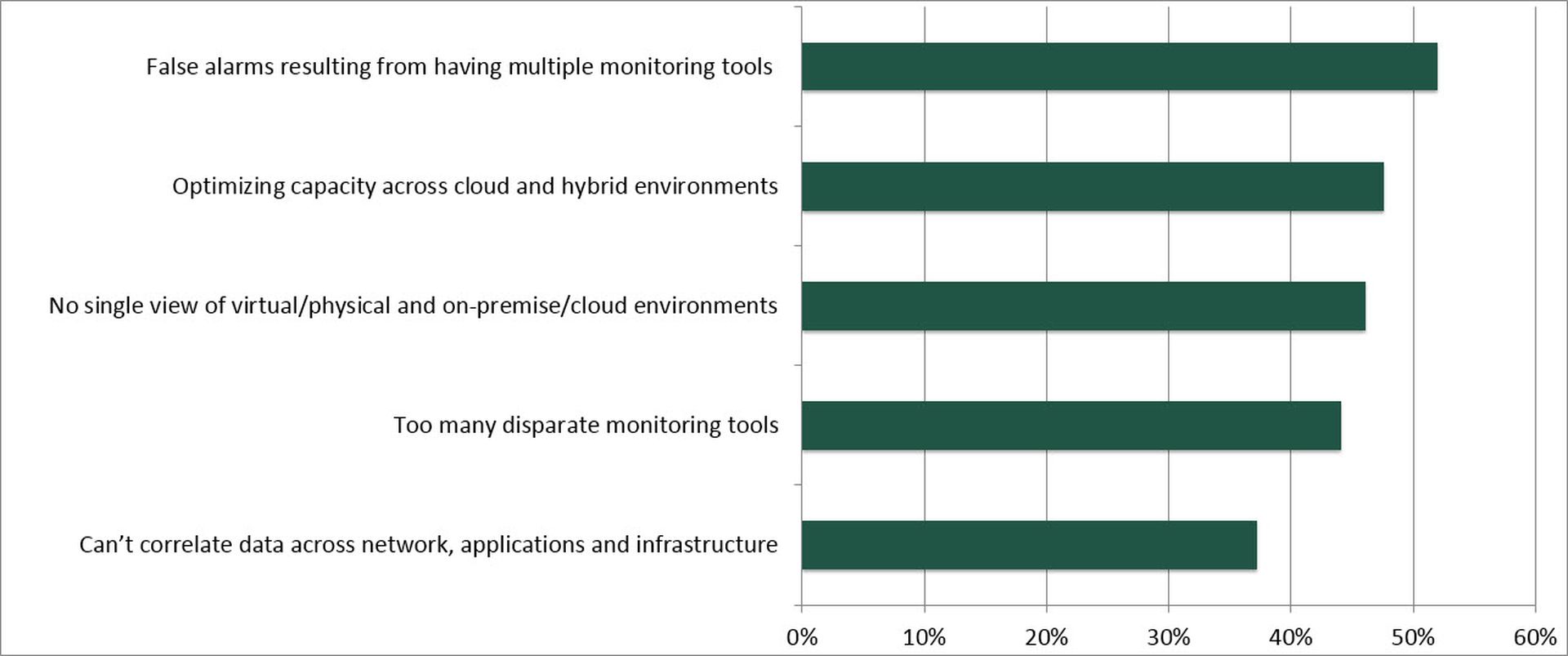

Lack of unified visibility

Another common area of trouble had to do with the limited visibility and insights associated with having multiple, isolated tools. Many indicated they were struggling with these issues: “False alarms resulting from having multiple monitoring tools,” “No single view of virtual/physical and on-premises/cloud environments,” “Too many disparate monitoring tools,” “Optimizing capacity across cloud and hybrid environments” and “Can’t correlate data across network, applications and infrastructure.”

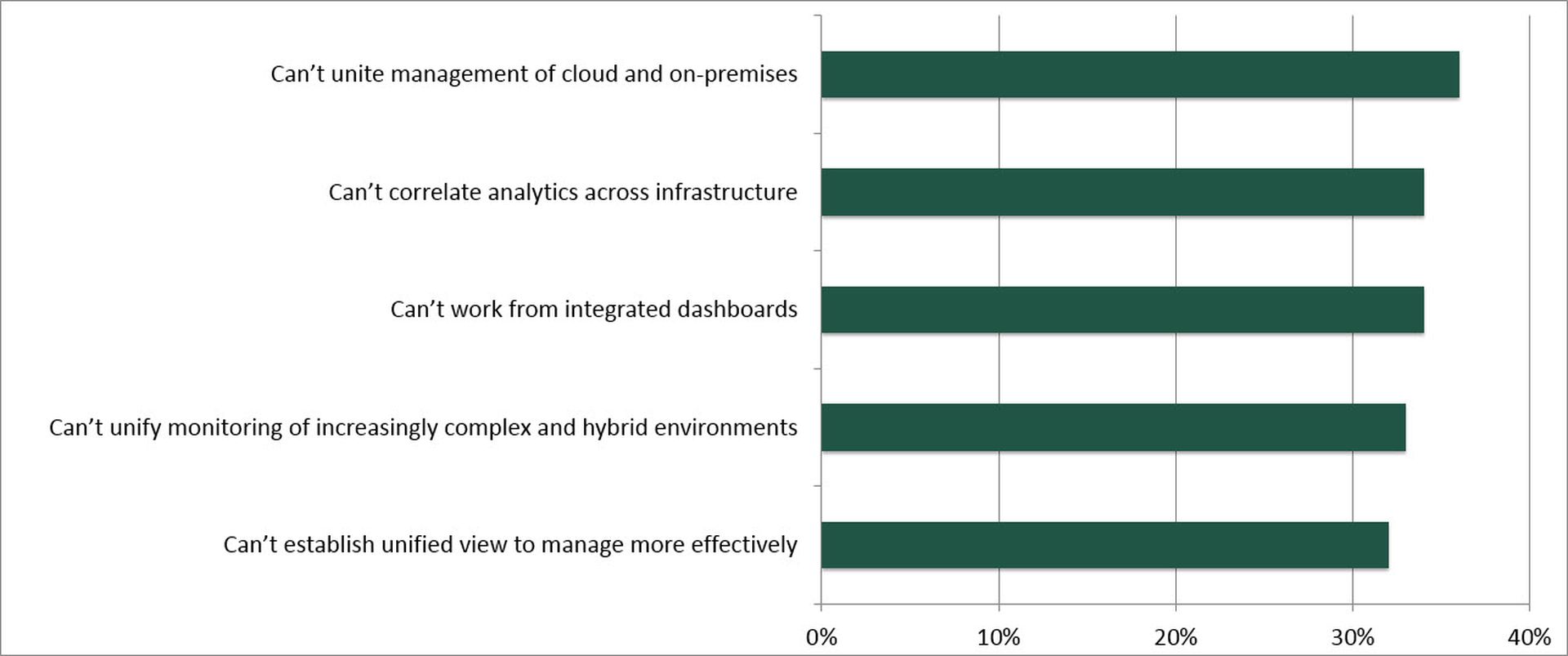

Tools Limitations

Respondents were also polled on their current tools’ limitations, and at least 30 percent of respondents rated their tools as lacking in 14 categories. A key theme was the inability to gain unified, correlated visibility. Here are few of the top-ten rated categories in which respondents indicated their capabilities for gaining unified visibility failed to be rated as “somewhat comprehensive” or “comprehensive”:

- Can’t unite management of cloud and on-premises: 36 percent

- Can’t establish unified view to manage more effectively: 32 percent

- Can’t work from integrated dashboards: 34 percent

- Can’t correlate analytics across infrastructure: 34 percent

- Can’t unify monitoring of increasingly complex and hybrid environments: 33 percent

Chart: Respondents who indicated their tools rate 1-3, with 1 being “very limited” and 5 being “comprehensive.”

The Opportunity

With the right services, tools and expertise, CSPs can help customers address all these challenges cited by survey respondents. Perhaps even more important, respondents indicate that they’re inclined to getting help in these areas from their CSPs. More than three-quarters (77 percent) state that they want the provider monitoring their cloud environment to also monitor their on-premises infrastructure and services. The same percentage of respondents want the primary CSP that is monitoring applications in their cloud to also monitor applications in a secondary cloud venue.

Not only were respondents eager to get help from their service providers, but they were willing to pay a premium to fix the issues they’re confronting. In fact, more than 50 percent are willing to pay a premium to get help in 14 different areas.

Conclusion

The survey results make it clear that challenges are significant for a vast percentage of organizations, and that customers are favorably inclined to enlist the help of their CSPs—if those providers can deliver the services required. BONUS: Be sure to download the 451 Research report and get complete insights into the survey’s findings and implications.

When it comes to monitoring services, the opportunities for CSPs are virtually limitless. A broad range of CSPs can deliver premium monitoring, and there’s a wide spectrum of services that can be delivered. In our next article, we’ll look at some specific strategies you can employ in order to add premium monitoring services to your catalog, and we’ll profile several CSPs that have added these services to their portfolio.

Ken Vanderweel is senior director of service provider solutions marketing at CA Technologies. Read more CA blogs here.