In recent years, CA Technologies has started offering whitespace assessments to MSP partners. Through these assessments, CA staff help MSPs to map existing service offerings against a comprehensive list of potential services, and identify gaps or “whitespaces” in coverage.

We recently sat down to interview Ken Vanderweel, Senior Director, Service Provider Solutions Marketing, who’s been leading this initiative since its inception. In this Q&A, Ken discusses the changing needs of the modern enterprise and why it’s so vital for managed service providers (MSPs) to deliver services that are aligned with these new realities. He then shows how, through CA’s whitespace assessments, the company is working collaboratively with partners to chart an optimized path for growth.

Why did you start doing these whitespace assessments for MSP partners?

Ken Vanderweel (KV): In order to serve our MSP partners most effectively, we felt we needed to cultivate a better understanding of the service provider market, including which types of providers there were and what types of services were being offered. For me personally, this effort grew out of a passion for serving our partners. For more than 12 years, I’ve focused on supporting service provider partners. Over that entire time, my roles have been all about helping MSP partners be more successful. Over the years, I’ve helped with everything from delivering marketing and positioning workshops to delivering sales tools and business guidance.

These efforts are just a few examples of the way CA collaborates with and supports partners. The whitespace assessments in particular represent an ongoing effort, one that CA commits significant time and effort to. These assessments exemplify our dedication to building long-term, mutual success with our partners, and our willingness to invest time and resources to support their growth.

When did you get started with delivering whitespace assessments?

KV: Several years ago, we embarked on a massive effort to catalog the services we were seeing in the market. Over the course of several months, we documented the service offerings of more than 1,200 service providers.

This initial research was tremendously useful for us and our partners. It gave us a critical understanding of various categories of managed services, including those that were well addressed and those that were only offered by a fraction of providers. This background was very informative, and it ultimately enabled us to serve our partners more effectively because we had a better understanding of where a given partner fit in the broader service provider landscape.

How has this whitespace assessment effort evolved?

KV: Since we first started doing assessments, we have evolved and advanced our assessments in several ways. These changes have been driven not only by what we’ve been seeing in the service provider space, but what we’ve been seeing in our enterprise accounts. CA has thousands of enterprise customers, which gives us real important insights in our work with MSPs; by seeing how enterprises are evolving, we also see how the needs and objectives of MSPs’ customers are changing. In recent years, we’ve seen significant changes in our enterprise accounts, and MSPs need to adapt to align with these new realities.

What kinds of changes have you seen, and how have they affected your assessment efforts?

KV: The first major change revolved around the reality that businesses are now operating in an application economy. No matter the industry, the success of a business is increasingly tied to the quality of its applications. We began adapting our assessments to align with this shift, distinguishing between traditional services and those that supported business success in the application economy.

More recently, we’ve been seeing how enterprises are now facing a new imperative: the need to build better apps, faster. This is prompting the move to establish a modern software factory. The modern software factory represents a blueprint for what enterprises need to have in place in order to compete successfully in the digital economy. There are a handful of key pillars in establishing the modern software factory, and we’ve started organizing our assessments to align with these categories as well.

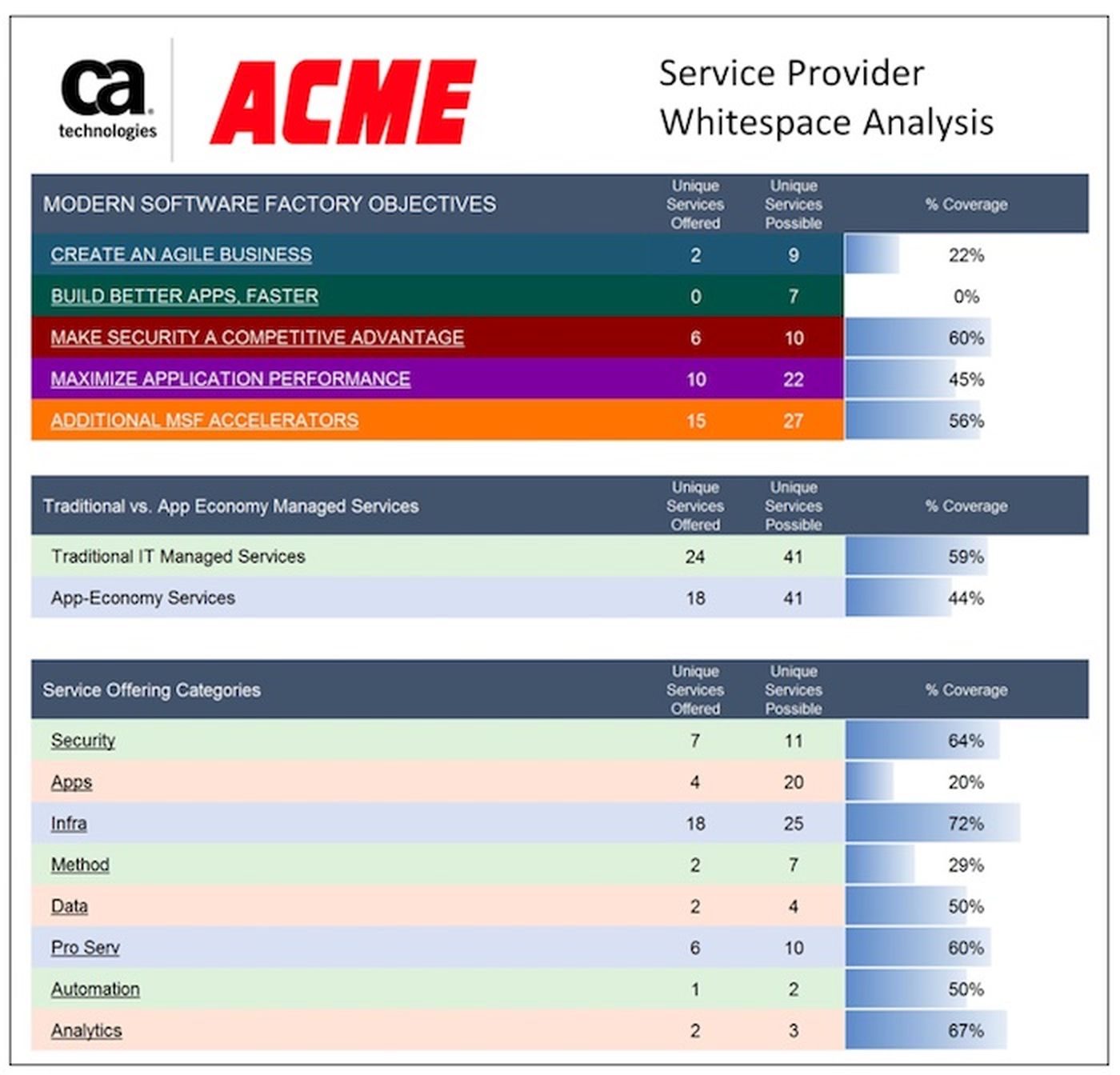

Now, our partners get to see a breakdown of their services in terms of how they support app economy objectives, and they also receive details around their support for modern software factory requirements.

How do you do whitespace assessments today?

KV: First, we focus on examining MSPs the way a new prospect would: By doing searches on relevant terms and examining the MSP’s web site. We’ve seen studies that show that the vast majority of decision makers develop a short list of providers in this way.

We take a detailed look at the partners’ site. We document the types of services that are featured and our assessments and recommendations. We then deliver our findings in extensive reports that we provide to partners.

What exactly is included in these reports?

KV: These reports include some background on the evolving needs of enterprises, specifically with respect to the emerging mandates that are associated with the modern software factory.

We then offer an assessment of the website itself, offering constructive feedback on what we’re seeing. We report on strengths and weaknesses we observe. This can include highlighting where content is weak or strong, the quality of marketing assets, the depth of coverage around services, ease of navigation and so on.

We then provide a detailed look at the service offerings featured, including several different views of coverage so readers can quickly see the categories where their coverage is strong and where whitespaces exist. These whitespaces reflect potential areas for new service expansion.

These reports also include suggestions for where some of the most compelling opportunities are for expanding services based on the provider’s existing catalog and expertise. This content is very much specific to the partner. We look at their current offerings and strengths, and, based on our understanding of where the market is heading, we provide highly customized guidance into where some of the most promising opportunities can be.

Quite often, we see opportunities for service expansion that are natural extensions of what the MSP is already doing. In addition, we also offer suggestions for how partners can enhance their web presence, based not only on our assessments of their sites but all the experience we have in working with MSP marketing teams.

What has been the response of partners who have received these reports?

KV: The response has been extremely positive. Our partners have been very appreciative and very cognizant of the value of these reports, particularly in light of the fact we do these for free. Several partners have been surprised that we offer this in-depth analysis at no charge, and have commented that they felt we could charge a significant amount based on the value they provide.

We provide these reports to top-level management within the partner organization, and it’s clear these decision makers are reading these reports and acting upon their guidance. For example, we’ve had several partners report back to let us know that they were making changes to their service catalog specifically based on the recommendations from these reports. Another common response that we hear is how unique these reports are. Our partners often tell us that none of their other vendors do anything like this, and they see this as a great testament to the fact CA truly partners with them, rather than operating simply like a vendor that’s selling them software.

Have there been any surprises as you’ve been doing these assessments?

KV: We continue to be surprised by the diversity of approaches and service catalogs we see. After doing so many of these, I would have thought I’d come to a new vendors’ site and see that it looks just like that of a prior business we assessed, but honestly that’s still not happened.

Pretty much no two provider sites or service catalogs are alike. There’s a lot of diversity, not only in the specific services being offered, but in terms of business models, packaging, marketing approaches and so on.

That’s part of what makes these assessments so compelling, I think. When it comes to directions for service catalogs, there are clearly no cookie-cutter set of changes that would make sense for every MSP. By taking time to examine a specific MSP and looking at how their offerings map to various categories, we can offer tailored insights that are truly actionable.

On the other hand, it’s been interesting to see that, while each assessment is focused on a specific partner, now that we’ve been doing this for so long and for so many different businesses, we’re gaining a lot of insights into broader market trends.

What are some of the top learnings you’ve gained through doing all these assessments?

KV: Today’s enterprises are fundamentally waging battles on two key fronts. First, they need to wring maximum agility and efficiency from their internal operations. Second, they need to deliver highly optimized, innovative and compelling digital interactions to customers. While both of these battles are critical, it will be the quality of a company’s digital interactions that will be the ultimate determinant of market success.

At a high level, we’re seeing that the majority of service providers and service catalogs are focused on internal operations. As a result, we feel there’s a strong opportunity for a number of MSPs. Those providers that can help customers enhance their digital interactions will be poised to address a strategic requirement and a growing demand.

In addition, through our assessments and our work with enterprises, we’re starting to identify some of the key approaches that distinguish those MSPs that are poised for growth and those that are in jeopardy of losing momentum and market share.

What are some of the characteristics that distinguish these companies?

KV: Ultimately, as enterprises and their requirements evolve, MSPs will need to evolve in turn. That’s why it’s so vital to move to align service catalogs with current customer requirements and ensure web sites also demonstrate that alignment. For example, we’re seeing that many providers have successfully transformed their sites to closely align with modern customer requirements, using positioning that’s focused on phrases like modernization, digital transformation and innovation.

Quite simply, those prospects that are looking to create a short list of vendors to consider, will increasingly move to the next vendor if the site they’re visiting doesn’t speak to their modern challenges and objectives. Those that adapt in this way can help ensure that customers and prospects view them as viable partners that can help them address their near- and long-term objectives

A lot of times these new services can be areas where MSPs can address a largely unmet demand, differentiate themselves from their competitors and ultimately command higher margins as well.

Anything else you want to add?

There’s a lot more information available on these assessments and our findings. To learn more, be sure to check out my recent posts on ChannelE2E:

Ken Vanderweel is senior director of service provider solutions marketing at CA Technologies. Read more CA blogs here.