Private equity firms continue to eat the MSP software market. ChannelE2E strongly suspects more deals will unfold before the end of 2019. Why's that? The short answer involves such factors as:

- a shift in the MSP (managed IT services provider) market, where organic "sell to" opportunities have largely matured in North America, but "sell through" opportunities remain particularly strong worldwide;

- growing SMB customer demand for cyber and data protection services; and

- large sums of private equity dollars waiting to be put to work.

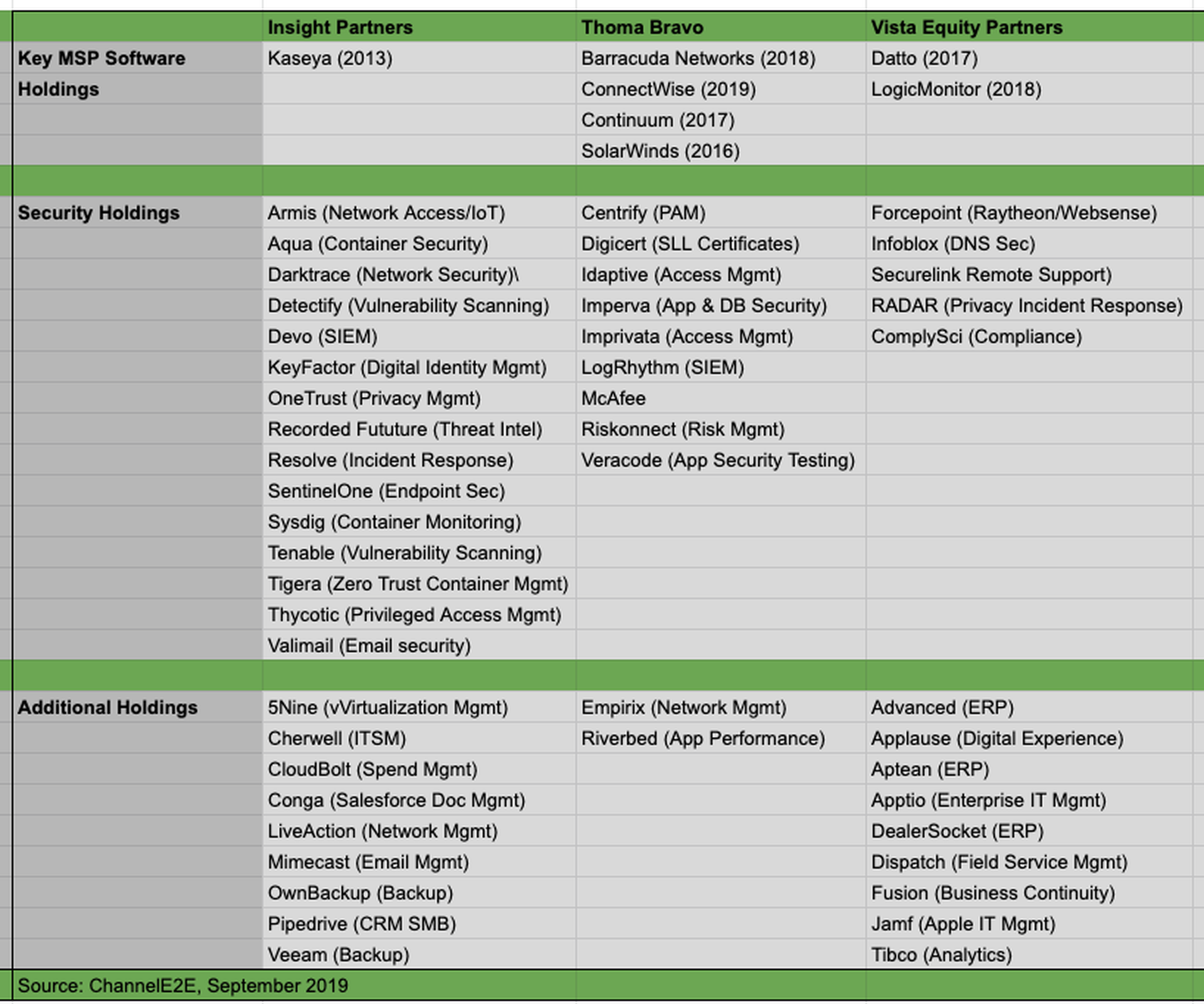

Key private equity firms working in and around the MSP software market include Insight Partners, Thoma Bravo and Vista Equity Partners -- along with such additional players as Apollo Management Group, Francisco Partners, K1 Capital, KKR, TA Associates and Marlin Equity Partners (among many others).

The chart below outlines where Insight Partners, Thoma Bravo and Vista Equity Partners have placed their bets so far across the MSP software, cybersecurity, backup and IT management markets.

Private Equity and MSP Software Companies: The Ownership List

MSP Software Platform Providers: "Sell To" vs. "Sell Through"

Poke around the list above, and you'll notice that the five major MSP software platform providers -- ConnectWise, Continuum, Datto, Kaseya and SolarWinds MSP -- have private equity backers.

Those five software companies have software and automation platforms that can be divided into two categories.

- "Sell-To" MSP Offerings: Such as RMM (remote monitoring and management) and PSA (professional services automation) software. Those toolsets allow MSPs to automate the way they manage end-customer systems as well as their own business operations. But within some markets -- particularly North America -- the "Sell-To" market has largely matured. The majority of recent RMM and PSA deployments in North America largely involve "rip and replace" migrations -- during which MSPs jump from one vendor to another based on features, functions and/or price considerations.

- "Sell-Through" MSP Offerings: This is the hotter, less mature area of the market. It typically involves cloud-based business applications, security, data protection and other services that SMB end-customers consume. The end-customers pay MSPs monthly fees to deploy, maintain, monitor and optimize those services.

Aware of those two market segments, private equity firms and their portfolio MSP software providers are scouring the market for "Sell-To" options that fill newly defined market gaps, and "Sell-Through" options to pump more services from vendors through MSPs out to end-customers.

MSP Software Platform Providers: Buyers or Sellers

Based on the market snapshot I've offered above, here's where I expect the five major MSP software providers (sorted alphabetically) may head next.

1. ConnectWise: Owned by Thoma Bravo since February 2019, ConnectWise has been looking for tuck-in acquisitions as well as bigger potential deals. We've heard occasional rumors that ConnectWise may acquire ITBoost, an MSP documentation and password management software company that competes with Kaseya’s IT Glue and SolarWinds Passportal. Neither ConnectWise nor ITBoost have publicly commented about M&A chatter that we heard starting in July 2019.

ConnectWise CEO Jason Magee

ConnectWise CEO Jason MageeAnother occasional rumor involves ConnectWise potentially acquiring Continuum. Speculation about such a business combo briefly surfaced back when Thoma Bravo acquired ConnectWise in February 2019 (see item 5 in this interview). Thoma Bravo has also owned Continuum since 2017. And speculation about a potential Continuum company sale surfaced in June 2019.

But does that mean ConnectWise and Continuum will eventually become one company? It’s interesting speculation. I don’t know if the two companies are in the same Thoma Bravo “fund.” If they sit in different funds, putting the two businesses together may involve some financial hurdles.

On the technology and services fronts, ConnectWise has a strong installed base of MSPs running its PSA and RMM software. Continuum is strong in NOC services. And each company offers a lengthy list of additional products and services — some of which involve overlap. On the partner front, ConnectWise says it supports more than 26,000 partners -- though perhaps the figure has now grown to about 27,000 partners (ConnectWise has added 1,000 channel partners since March 2019). Continuum points to 6,000 partners.

So what’s next — if anything? I’m listening but haven’t heard anything firm about all this speculation. My eyes and ears will be wide open at Continuum Navigate 2019 (Pittsburgh and Las Vegas) and ConnectWise IT Nation Connect 2019.

We're also watching to see if ConnectWise deepens a relationship with IT By Design, a NOC provider that competes in some ways vs. Continuum.

2. Continuum: Owned by Thoma Bravo since June 2017, rumors about a potential Continuum company sale surfaced in June 2019. We've also heard chatter about a potential Continuum-ConnectWise business combination (as outlined above), and a recent Continuum product suite rebrand looks strikingly similar to how ConnectWise rebranded its own suite in 2016.

Still, I haven't heard anything firm about a potential Continuum and ConnectWise business combination, an there's always a chance that the original "Continuum for sale" rumor from June 2019 was nothing more than a test balloon in the market to measure the company's potential valuation.

Continuum CEO Michael George and the executive team have been on a near decade-long journey with the company. The overall business provides IT automation services to MSPs -- essentially allowing MSPs to focus on sales, while delegating help desk, remote monitoring, storage and security services to Continuum software and Continuum technicians.

Continuum in October will show off its Pittsburgh-based SOC (security operations center) during a partner conference. We'll be watching and listening closely for the company's next potential moves.

3. Datto: Owned by Vista Equity Partners since December 2017, Datto has been relatively silence on the acquisition front since swallowing Autotask.

About a week ago, a key source in the MSP industry asked me if Datto was set to acquire ConnectWise. But it sounded like pure speculation or misinformation to me rather than anything based on credible information.

Led by CEO Tim Weller, Datto has been scouring the market for more "sell through" solutions that MSPs can promote to end-customers. Security, security and security certainly come to mind as potential market targets -- but lofty startup valuations may have forced Datto to walk away from some potential deals, ChannelE2E believes.

Long term, Datto wants to go public. But I also wonder if the company would be a good buyout fit for a PC or server company that wants to understand and engage the MSP market. HP Inc. or HP Enterprise are two names that come to mind...

4. Kaseya: Insight Partners has owned Kaseya since 2013. Conventional wisdom says Insight should be looking to exit Kaseya by now. But Kaseya CEO Fred Voccola has a knack for defying conventional wisdom.

Voccola hinted back in 2017 that Kaseya would contemplate an IPO filing in late 2018 with a potential offering sometime in 2019. In contrast, I suspected that either another private equity firm or a strategic buyer would scoop up Kaseya. For instance, I've occasionally wondered if KKR would acquire Kaseya and tuck it into BMC Software -- giving enterprise and midmarket CIOs a single vendor for IT management and automation tools.

Still, that type of deal is pure speculation on my part. And every time I suspect Kaseya is a seller, the company actually turns out to be a buyer. The company, backed by $500 million in new funding earlier this year, acquired ID Agent for Dark Web Monitoring as part of a deal disclosed in May 2019.

Kaseya continues to aggressively cross-sell a growing list of solutions that the company has acquired -- particularly ID Agent, IT Glue, RapidFire Tools and Unitrends, The strategy generated considerable chatter at last week's IT Glue GlueX conference in Phoenix, according to sources that checked in with ChannelE2E.

Despite all that, I still think we'll see something bigger unfold in the next several months. At some point, Insight Partners and Voccola will want to unlock the value they've created. July 2019 will mark five years since Voccola arrived at the company, stabilized the business, restored growth and ultimately restored Kaseya's credibility with MSPs...

5. SolarWinds MSP: October 2019 will mark one year since SolarWinds returned to public markets with an IPO. But private equity firm Thoma Bravo still owns a stake in the company, and SolarWinds has continued to acquire businesses -- such as Passportal for password management, and Samanage to counter ServiceNow in IT service management.

During an August 2019 earnings call, SolarWinds CEO Kevin Thompson said the company's big three priorities involved MSP, service desk and cloud-based application management software initiatives. Thompson also offered some interesting M&A comments on the call, essentially saying that the company would consider large and small deals -- but he also warned analysts not to read too much into his comments. In other words, the team continues to scour the market for deals but that doesn't mean an M&A announcement is imminent.

What might SolarWinds acquire next? Some clues surfaced at the recent SolarWinds Empower MSP conference in Atlanta. Only a select group of MSP software companies were invited to participate in the conference. It's a safe bet SolarWinds MSP GM John Pagliuca and his team monitored booth traffic and MSP activity at the conference to see which third-party tools generated MSP chatter. Among the companies on-and: Liongard and ServiceTree, though we haven't heard any M&A chatter about those to firms.

MSP Software Companies: More Potential Buyers, Sellers

Meanwhile, private equity firms like Vista Equity and Thoma Bravo are sitting on big piles of money to make more acquisitions. At the same time, a lengthy list of private equity- and publicly-owned software companies could be buyers or sellers in the months ahead. Many of the companies are in the highly fragmented backup and disaster recovery market.

Names to know, sorted alphabetically, include:

1. Acronis: The backup and disaster recovery company recently raised $147 million led by Goldman Sachs. It's a safe bet the privately held unicorn will double down on the security market with some security-minded and data-minded acquisitions.

2. Arcserve: Marlin Equity Partners acquired Arcserve from the former CA Technologies in August 2014. Fast forward five years and Arcserve could be either a buyer or a seller in the data protection market. Faced with the convergence of data backup and cybersecurity, it's a safe bet Arcserve is looking to work more closely with endpoint protection companies.

3. Axcient: Under the leadership of Webroot veteran David Bennett since February 2019, Axcient has carefully refined its marketing around a "protect everything" message. Key 2019 moves at the backup and data protection company include a new lead generation program for MSPs; a new marketing enablement portal; and executive moves involving service and support; channel partnerships; product leadership; and overall revenue generation. Axcient includes the former eFolder assets, and is backed by K1 Capital. We heard some rumors earlier this year that K1 may be looking to sell the business but we never heard anything firm about the chatter.

4. Barracuda Networks: In some ways, Barracuda Networks has emerged as the sixth big provider of MSP software platforms. Thoma Bravo acquired Barracuda and took the security company private in 2017. Barracuda CEO BJ Jenkins has aggressively focused on an MSP-centric channel strategy that now includes RMM (remote monitoring and management), security awareness training, email security, data protection and other services. If we had to guess, we suspect Barracuda will continue to pursue tuck-in acquisitions. And perhaps Barracuda will return to public markets in an eventual IPO move that may mirror another Thoma Bravo portfolio company -- namely, SolarWinds MSP.

5. Carbonite: After acquiring Webroot in early 2019, Carbonite itself has been the subject of for sale rumors. Interim CEO Steve Munford has been running the company since Mohamad Ali stepped down in July 2019 to join a media company. Recent moves include moving several Webroot executives onto the Carbonite executive team. Next up, a simplified partner program is expected to make it easier for MSPs to sell the entire Carbonite and Webroot data protection and cybersecurity product lines.

6. Sophos: Widely known in the MSP security software market, Sophos is publicly held. Quarterly earnings have hit occasional turbulence over the past year or so -- and that makes us wonder if Private Equity will ever step in and take a look...

7. StorageCraft: Private equity firm TA Associates acquired StorageCraft in January 2016, and hired Dell SonicWall veteran Matt Medeiros for the CEO post. Multiple acquisitions have since surfaced -- including Gillware (2016) and Exablox (2017). A more flexible partner program arrived in late 2018. StorageCraft is the rare backup company competing at the high-end of the market and in the midmarket, while working with a diverse range of MSPs and VARs in the SMB sector. We haven't heard any M&A chatter around the company, but we continue to listen closely considering all the market interest in data protection...

8. Whom Did We Miss?: Got speculation about potential mergers and acquisitions in the MSP software market? Send me an email ([email protected]). I'm all ears.

PS: Conferences to track for potential M&A activity include:

- Continuum Navigate 2019 (Pittsburgh and Las Vegas);

- ConnectWise IT Nation Connect 2019;

- DattoCon Paris 2019; and

- Kaseya's Connect IT Europe 2019.