Kaseya has acquired Vorex, a niche PSA (professional services automation) platform. Next up: A potential PSA price war vs. Autotask, ConnectWise and Tigerpaw Software, as Kaseya CEO Fred Voccola attempts to position those rival offerings as expensive, antiquated options for MSPs.

Vorex will be rebranded as Kaseya Business Management Solution, and priced at $25 per user per month for complete PSA functionality, Voccola tells ChannelE2E. Kaseya is offering a free one-year PSA license to MSPs that switch from ConnectWise, Autotask, and Tigerpaw -- though I don't know how many users within each MSP are covered by the offer. A typical migration requires a few days or weeks, depending on an MSP's size, but certainly not months, Voccola says.

More than an acquire-and-rebrand move, Kaseya says it has quietly partnered with Vorex to develop the platform's MSP capabilities. Kaseya Senior VP and GM Miguel Lopez has worked closely with Vorex CEO Mike Salem on the effort. Salem remains with Kaseya as part of the Vorex buyout. Financial terms were not disclosed, but Voccola says the two companies have invested $25 million in the multi-year R&D effort to bring Kaseya Business Management Solution to market.

Who Is Vorex?

Vorex launched in 2007 and expanded into the MSP market by September 2014. At the time, MSP industry veteran Stu Selbst drove the partner effort (he's now VP of Channels at MyDigitalShield).

In 2015, multiple Vorex product integrations began to surface -- including a connection to Naverisk RMM and Continuum. By June 2015, Vorex also was positioning its cloud as an ERP and business management solution more aggressively for telecom companies.

By mid-2015, Vorex had about 15 employees, generated about $2 million in annual revenues, supported hundreds of customers, and was growing about 7 percent to 15 percent per quarter, according Dallas Business Journal.

MSP Budget Priorities

Now, Kaseya owns that niche but growing platform. By offering PSA at an aggressive price, Voccola says MSPs can shift more of their budgets toward tools that spark new and recurring revenue pipelines. He claims Kaseya's RMM, Office 365 management and security tools can deliver a 20X return on investment (ROI) to MSPs, while PSA is best positioned as a tool to improve business efficiencies.

"We think the PSA market is commoditized," says Voccola. "And the first-generation of products weren't designed to be nimble enough for today's MSPs. We've got a best-in-the-business solution. It's fully integrated with Kaseya but the APIs are wide open for third-party integrations." Kaseya VSA is the company's established RMM platform.

ChannelE2E is reaching out to Autotask, ConnectWise and Tigerpaw for their views on the Kaseya move. We'll update this article accordingly if/when we have updates to share.

PSA, RMM and Beyond

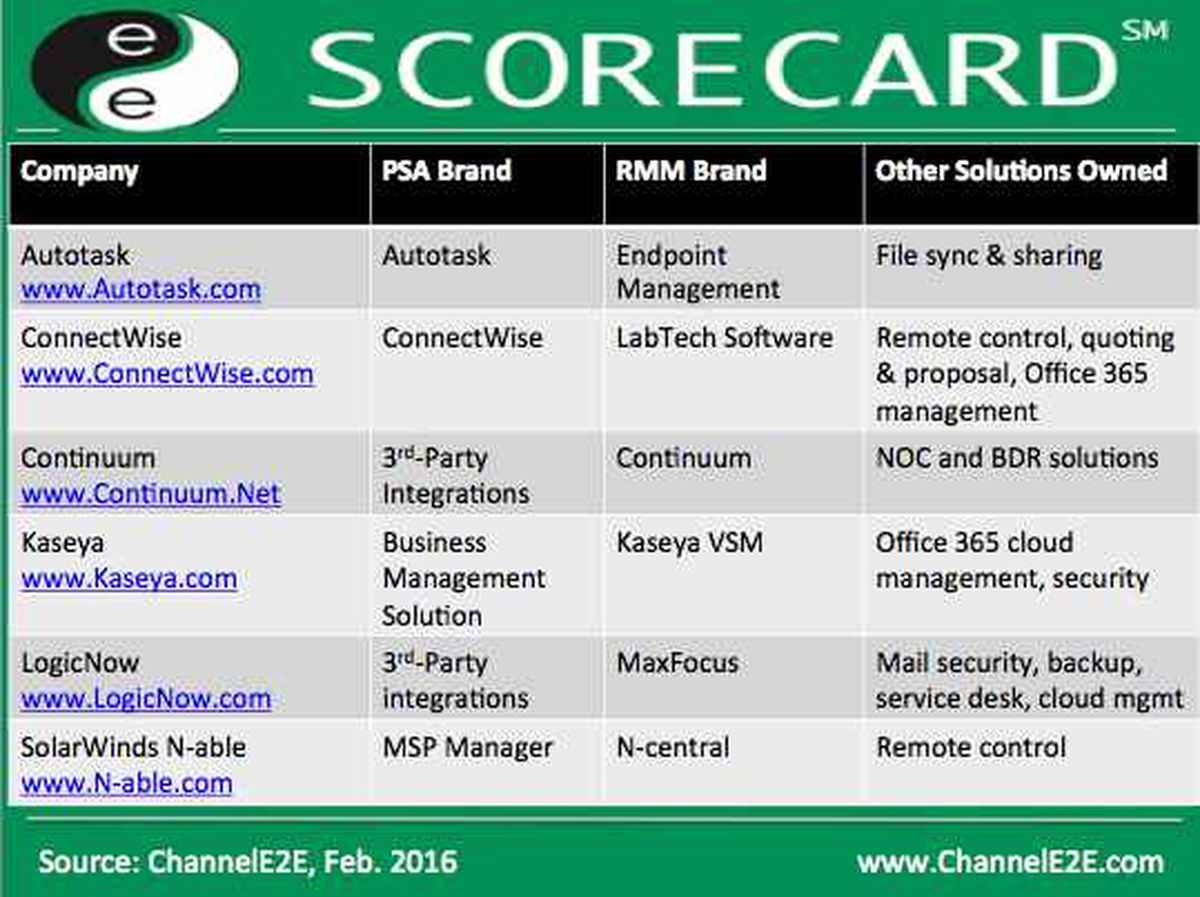

Kaseya is the latest in a growing list of MSP software providers that offers both PSA and RMM (remote monitoring and management) capabilities, or additional platform extensions (see chart below).

ConnectWise sparked the PSA-RMM convergence trend in 2010 when it invested in LabTech Software -- undercutting Kaseya's RMM pricing at the time. ConnectWise CEO Arnie Bellini essentially set the stage for software suites to emerge in the MSP software market.

Gradually, rivals like Autotask and SolarWinds N-able acquired RMM and PSA technologies, respectively. Other RMM providers like Continuum and LogicNow have been rounding out their MSP software portfolios in other areas. (Just today, Continuum introduced new APIs for PSA integration.) And storage specialists like Datto and eFolder also have been branching out into additional markets serving MSPs, while larger enterprise players like CA Technologies have moved RMM toward application optimization and customer experience.

Within the SMB managed services market, the line between PSA and RMM is blurring and perhaps even disappearing in some cases. ConnectWise touted new LabTech integrations during IT Nation 2015. SolarWinds just released a blurred PSA-RMM offering, and Autotask is expected to do so this month, that company has told ChannelE2E.

Vorex PSA Becomes Kaseya Business Management Solution

Now, Kaseya is countering as well. The new Kaseya Business Management Solution supports sales, marketing, human resources, client project management and IT service delivery at a price that is 66% lower than current PSA offerings, Voccola asserts.

Still, ChannelE2E believes it's important to note that PSA and RMM price points can vary greatly when MSPs either (A) consume software from a single vendor or (B) scale to more users. In other words: Your monthly spend will vary based on your company size, the overall amount of software you consume and the subscription deal you negotiate.

Kaseya also alleges that its PSA offering is cloud centric and intuitive, and doesn't suffer from legacy software models. Tigerpaw is still client-server based, though a cloud offering is expected this year. Autotask started as an Microsoft-centric (.Net) cloud design but has since expanded to support more browsers and mobile operating systems. And ConnectWise was client-server but now has a cloud approach.

Kaseya: On the Rebound?

Kaseya was an early MSP industry software pioneer. But during ownership and leadership transitions in recent years, some MSPs grew frustrated with pricing models, employee turnover, R&D bumps and support issues. Some MSPs abandoned Kaseya over the issues.

By mid-2015, Voccola arrived as CEO. He took steps to overhaul Kaseya R&D and customer support, and attempted to mend fences with numerous MSPs. By late 2015, it sounds like Kaseya's business had stabilized and was growing again in several areas, though ChannelE2E doesn't have exact financial details.

While Kaseya Business Management Solution sounds promising the company continues to face fierce competition on all fronts. Also, MSPs don't take PSA and RMM switch-outs lightly. The potential land-grab to watch ultimately involves MSPs that currently run:

- Kaseya VSA for RMM.

- Autotask or ConnectWise for PSA.

Several thousand MSPs worldwide likely use a combination of those products. Now, Kaseya wants its RMM customers to embrace the company's new PSA offering. ConnectWise has offered a similar PSA-RMM bundled message since 2010 and Autotask has been in the market with its PSA-RMM bundled alternative since 2014. How many MSPs are willing to make a PSA or RMM platform change? And how many new or emerging MSPs are seeking a single-vendor solution? We'll be watching.