Imagine you picked up the phone and heard the following pitch from a sales rep at a software-as-a-service company selling to your MSP…

“Hi! Our brand-new product lacks eight crucial features and crashes about twice a week. And I’m not totally confident we’ll still be around in six months, and we only have one support guy. But we’re cheap! Can I offer you three months for free?”

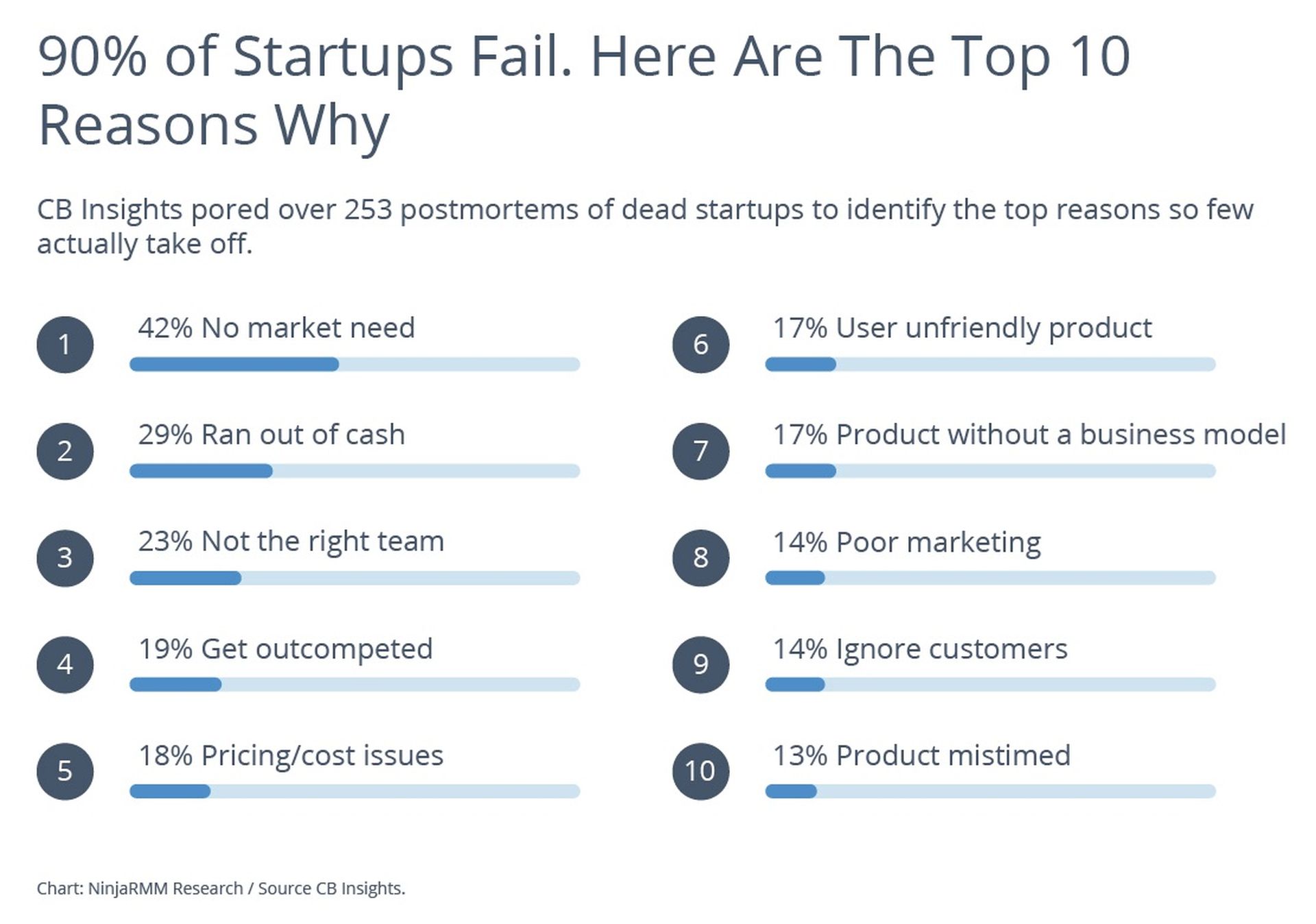

Raises an eyebrow, right? And he’s not kidding about going out of business: CB Insights found that 90% of startups fail within the first four years.

What if you got the following pitch instead?

“I’ve got an incredible offer for you -- we want you to pay more and commit to a three-year contract. In return, you’ll get infrequent updates and endless waits for customer service. And that’s not all! We just laid off your usual rep, and don’t expect to hear from him again as he’s busy training his replacements in Bangalore.

Wow, that’s a terrible offer. Frankly, you’re getting sold a lemon, and no one in their right mind would say yes. But that’s implicitly the deal a lot of older software vendors are offering their customers these days.

Why? It’s not like the employees at these companies turned into bad people overnight. It’s that they are in the late stage of what I’m calling their “software life cycle.” In the cycle, companies move between three stages: startup, growth, and maturity, with investment and acquisition events that coincide with each stage.

There’s trouble at both ends of the software company life cycle. Startups tend to flail, because they simply don’t have the resources to offer both a robust product and strong support. Meanwhile, mature companies are burdened by an aging technology stack -- a bit like dragging around a once-useful VCR in the age of streaming video. The stale product combines with an older company’s particularly strong incentive to boost profits in a way that increases prices and worsens support.

Neither very young nor old companies are able to offer a competitive product at a fair price.

MSP SaaS companies in the middle growth phase, however, are in a “Goldilocks” stage for customers, with an attractive blend of reasonable prices, a modern technology stack, and reliable customer service. But you’ll want to pass on the flailing newbs and the squeezed legacy players!

Flail: The Startup (Years 0-3)

We’re all familiar with the romance of the startup entrepreneur chasing the dream: the endless workdays, cots in the office, the Top Ramen meal plan. And there are good things about having a young startup behind your RMM. The technology is typically cutting-edge, and the prices are low.

However, because the product is so new, there are often features missing, and the service outages occur with alarming frequency.

And since 90% of startups fail, that means that even founders who have built promising technology usually go out of business. CB Insights performed a post-morterm of 101 dead startups, and found that 42% cited “no market need” for the product as the primary reason for failure and 29% cited “Ran out of cash” as #2. (see chart).

Building out all the features needed for a “minimum viable product,” without running out of money, is a huge challenge--one too great for the vast majority of startups. The last thing you want is to move dozens of endpoints to a new SaaS tool, only to be “marooned” when the company goes under.

The Goldilocks Years: The Growth Startup (Years 4-8)

A far better bet is to go with a startup that has survived that sketchy early phase and has developed a big enough business to attract growth-oriented equity. You end up with a company in the sweet spot of the software company life cycle. The technology stack is still relatively new, and yet the company has the funds to keep adding new features that make it stand out from the competitors.

The newer stack also means that the company can produce features much faster. And they don’t have to waste time building obsolete features that you’d find in mature products (“Uninstall Netscape,” anyone?).

Companies in the Goldilocks phase may be missing a few features, and prices may have gone up since the early days. Yet the founders and employees are still energetic and ambitious, and finally have the experience and money to do their best work. Everyone wins.

Has My App Turned Into a VCR? The Pitfalls of The Mature SaaS Company (10+ years)

A decade is a long time in “software years,” given how fast generations of technology become obsolete. And that’s particularly true with complex products like the tools used by MSPs, which must operate in varied computing and office environments, with dozens of features. Innovating on an ancient legacy product is like upgrading VCRs to compete against Netflix and Amazon Prime -- possible, but doing so requires extraordinary effort.

Here are a few strategies company managers use to work around an aging stack…

Retrofit: Acting in good faith, some mature product development managers will pedal really hard to add new features and capabilities. But they face the limitations of an outmoded technology stack that was never intended for the cloud-based computing environment. These limitations result in awkward workarounds, such as deploying virtual machines to simulate a “SaaS-like solution” with a product originally designed to be run on site using a dedicated server. Or they will purchase several smaller companies and stitch them together to close feature gaps. Often this stitching and retrofitting results in higher staff and hosting costs for the vendor, which ultimately get passed along to customers.

Lipstick on a pig: More cynical players might take a “lipstick on the pig” approach. For example, they will retool the UI using all the latest tools available to make it look like a newer SaaS platform, but under the hood, it’s the same engine. And they’re reluctant to change much about the product in any case, because doing so might confuse the existing customer base.

Milk the cow: Or management might choose to “milk the cow,” which means hanging on with what the company has, accepting the inevitability of decline. They maintain the product and focus on drinking in the income stream while it lasts, knowing that the market share will erode. It’s a profitable ride, but innovation is not in the budget.

Selling the Company: Mergers and Acquisitions: One option vendors choose is to put the company up for sale -- what’s known in the trade as a mergers and acquisitions (M&A) transaction. Once the vendor gets bought, priorities and incentives change. Whether the new buyer is a corporation or private equity firm, the new goal of M&A activity is a laser-like focus on better profit margins. This could result in:

- Layoffs

- Offshoring staff

- Cross-selling other products

- Top talent leaving the company

- Raising prices

- Long-term contracts

Customers often don’t know the full story, and while increasingly irritated, they stick around rather than replace a mission-critical system.

If a normal consumer software company in a competitive market – like a music streaming-service, for example -- tried raising prices and cutting support for a steadily worsening product, they could expect mass customer defections.

The new company owners are betting that most MSPs and other IT professionals will hang on because ripping out a complex SaaS tool and putting in a new one is just too painful. The unspoken customer support motto becomes: “You may be unhappy with the changes we’ve just made, but you’re stuck.”

Conclusion: Switching to a Goldilocks Company Is Worth the Effort

In spite of the pain of migration, MSPs and IT managers should strongly consider changing to SaaS vendors that are in the Goldilocks portion of the software company life cycle. (And these modern companies have put a lot of effort into simplifying the onboarding process). If you’re on a platform that’s too old or too young, your current experience will likely go from bad to worse. Startups in the innovation stage offer the “just right” combination of advanced tech, reasonable prices, and responsive support. Let your risk-averse competition suffer through outages, high prices, and bad customer service.

Andrew Rosenblum is the Community Manager at NinjaRMM. His past work has appeared in Popular Science, the MIT Technology Review, Wired, Neo.Life, and other publications. Read more NinjaRMM blogs here.