Presidio, owned by Apollo, is exploring a potential initial public offering (IPO), according to an SEC filing today. If Presidio actually pursues and completes an IPO, the company will use the net proceeds to "repay or redeem certain of our indebtedness, with any remaining net proceeds to be used for working capital or general corporate purposes," according to the filing.

> Related:: Presidio files updated prospectus, Feb. 27, 2017

The document reveals strong growth for the midmarket IT service provider and consulting firm. Among the 10 items to note:

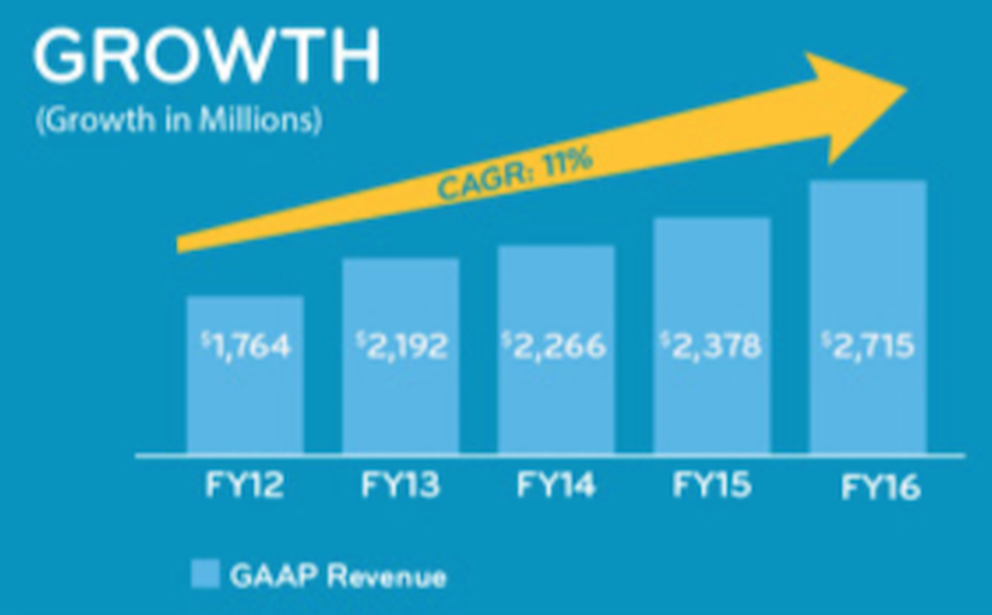

1. Annual Revenues: Presidio's annual revenues were $2.715 billion in fiscal year 2016, up from $2.378 billion in fiscal year 2015. The company's has an 11 percent compound annual growth rate (CAGR) since fiscal year 2012.

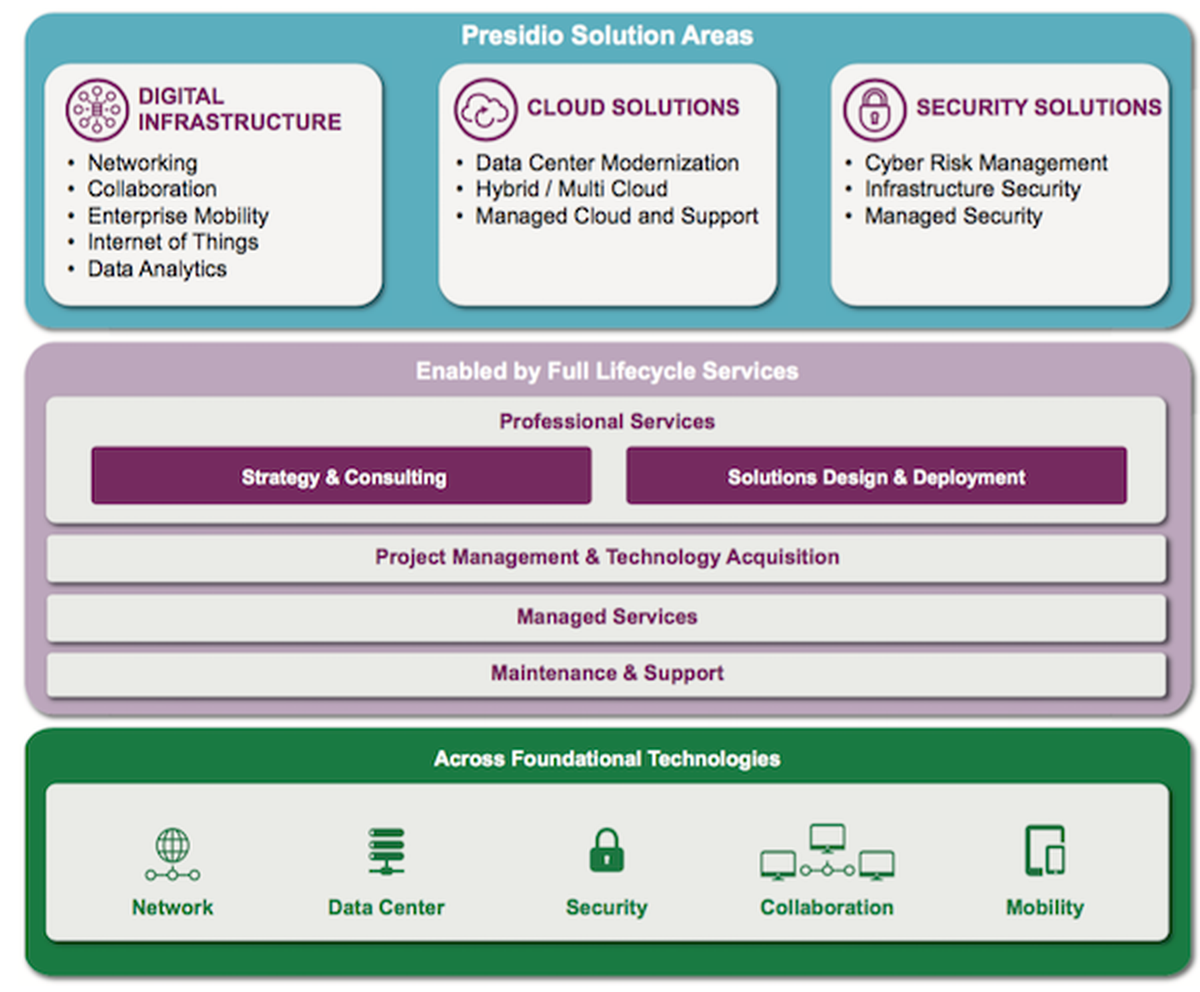

2. Specialties: Presidio has been betting its business on three core focus areas -- digital infrastructure (76% of revenues), security (9%) and cloud (15%). The following graphic, from the SEC filing, paints a picture of those services:

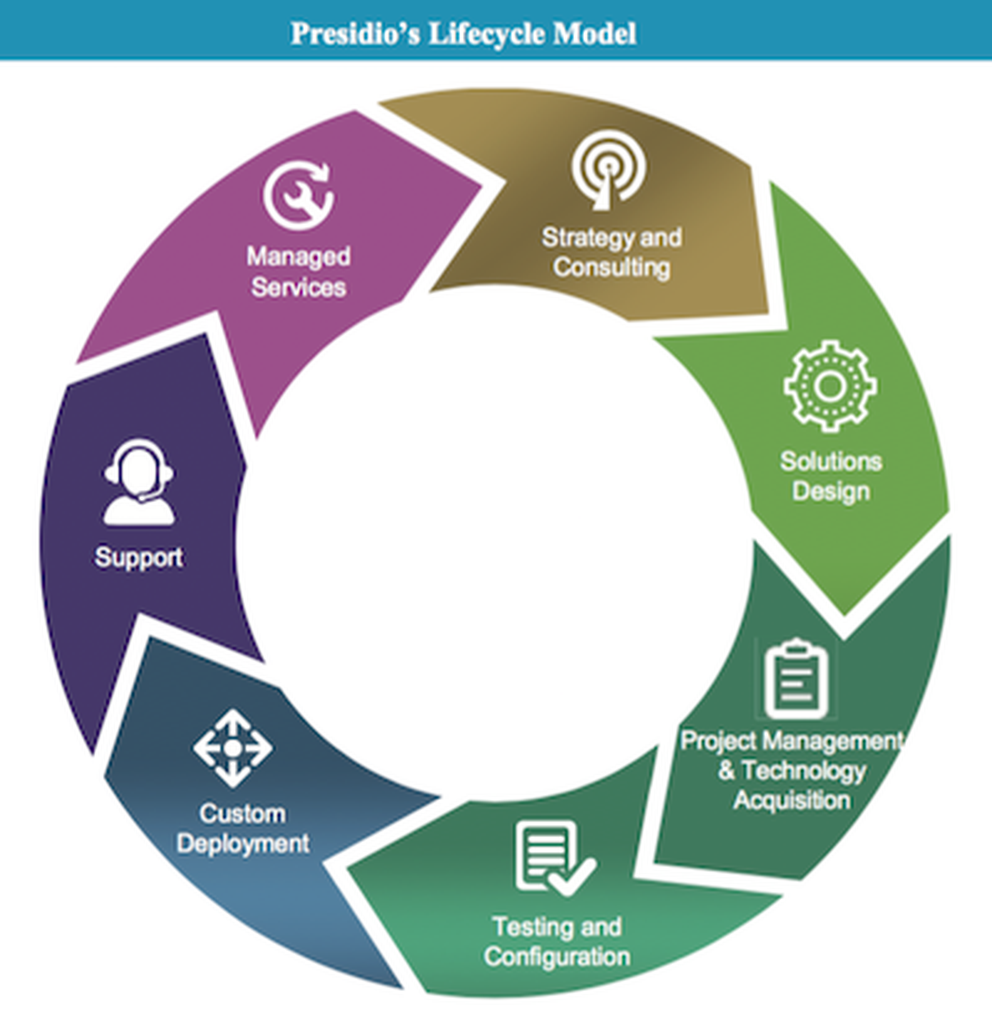

3. Blended Business Model: Presidio's lifecycle delivery model focuses on (1) strategy and consulting, (2) design and implementation and (3) managed services and IT as a service.

4. Customer Base: Presidio has 7,000 customers, a 95 percent customer retention rate, and generates roughly $400,000 per customer per year.

5. Vertical Markets: Roughly 70 percent of Presidio's customers are mid-market organizations, 17 percent are government and 13 percent are large enterprises.

6. High-touch Model: Presidio employs roughly 2,800 people across 60+ offices. The company has 1,600 technical engineers to 500 account managers -- a 3:1 ratio.

7. Competitive Strengths: Presidio points to six competitive strengths. They include:

- Leading provider of IT solutions to the middle market

- End-to-end enterprise-class solutions

- Cutting-edge technology capabilities with proven record of capitalizing on technological shifts

- National scale with local relationships driven by an industry-leading team of engineers

- Broad and loyal client base

- Strong domain expertise

8. Risk Factors: In filings like this, companies always disclose potential risks to their business. In Presidio's case, the company points to these five risk variables:

- a reliance on key vendors and any potential termination of those relationships;

- the role of rapid innovation and the introduction of new products in the IT industry;

- the company's ability to compete effectively in a competitive industry;

- risks pertaining to a substantial level of indebtedness; and

- risks associated with investing in a controlled company.

Note: As of Sept. 30, 2016, the company had $1.064 billion in total debt, including...

- a $730 million term loan facility due in February 2022

- $222.5 million, 10.25% senior notes due in February 2023

- $111.8 million, 10.25% subordinated notes due February 2023.

9. Net Income: Presidio's net income for the fiscal year 2016 involves a net loss of $31.2 million -- an improvement from the $114 million net loss in fiscal 2015.

10. EBITDA: Presidio's EBITDA was $211 million for fiscal year 2016, compared to $184.8 million in the fiscal year 2015.

Assuming Presidio actually launches an IPO and goes public, the result would be a "controlled company" -- meaning that parent Apollo will continue to control a majority of the company's voting common stock.

To track mergers, acquisitions and IPOs involving VARs, MSPs and CSPs, visit the ChannelE2E Milestones section daily.