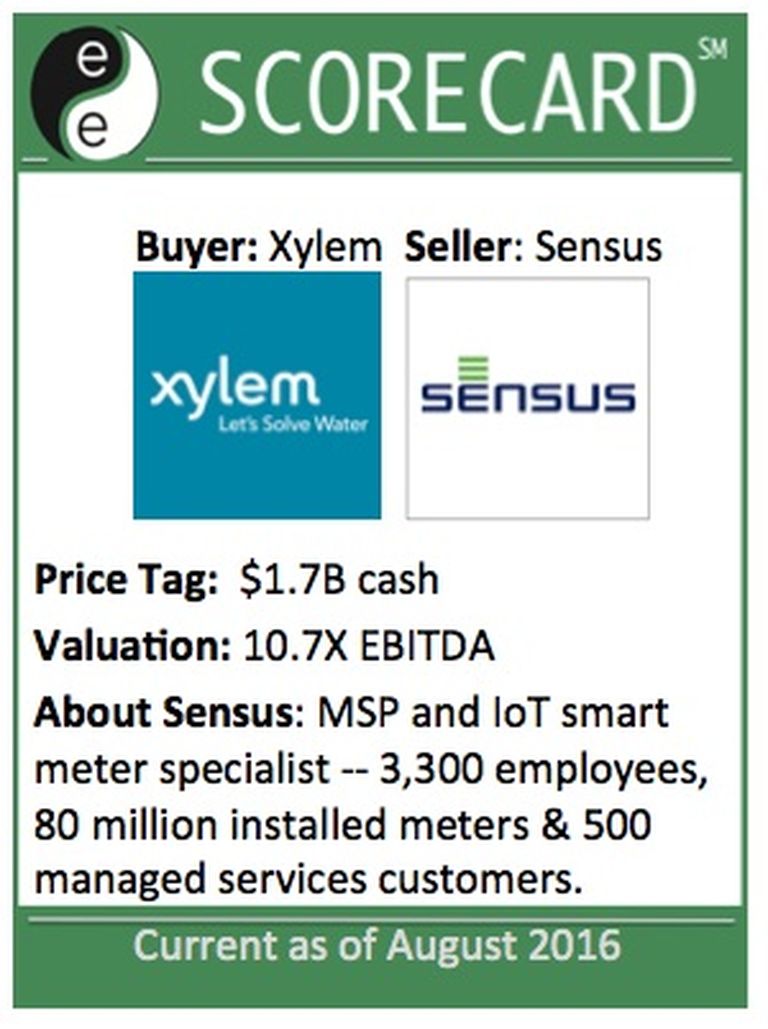

In one of the largest MSP acquisitions ever, Xylem Inc. has acquired Sensus for $1.7 billion in cash. Sensus is an enterprise-class managed services provider (MSP) with more than 500 customers.

Together, Xylem and Sensus will extend managed services to smart meters, network technologies, and advanced data analytics services for the water, electric and gas industries.

The potential company synergies appear massive: Sensus has more than 80 million metering devices installed globally. The company's MSP team specializes in network, security, database and systems administration needs, while also delivering the Sensus Advanced Metering Infrastructure (AMI) and Distribution Automation solutions.

Deal Valuation

Sensus has roughly 3,300 employees and major locations in the U.S., United Kingdom, Germany, Slovakia, and China. Nearly 70 percent of 2016 revenues were generated in the U.S. The company generated $837 million in adjusted revenue and $159 million in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) in fiscal 2016, which ended March 31, 2016. The $1.7 billion cash purchase price is 10.7x Sensus’ fiscal year 2016 adjusted EBITDA -- far higher than the typical 6X to 8X EBITDA multiple that smaller MSPs often fetch.

Of course, Sensus isn't your typical MSP. The company's intellectual property extends across multiple vertical markets -- including smart cities, smart energy, smart places (i.e., college campuses and industrial parks) and smart water. Sensus also is a giant in the advanced metering infrastructure (AMI) market -- which is growing twice as quickly as the overall metering market, the companies say.

Xylem, meanwhile, is a smart water expert looking to push into additional markets. “With Sensus, we will acquire a strategically valuable asset that will accelerate our ability to bring systems intelligence solutions to customers across the water and energy industries, establish a foundation for future growth and create significant shareholder value,” said Patrick Decker, Xylem president and CEO, in a prepared statement.

Xylem also expects to accelerate FlexNet -- a Sensus network platform -- into multiple IoT markets.

The deal, which is subject to regulatory approval, is expected to close in Q4 2016.