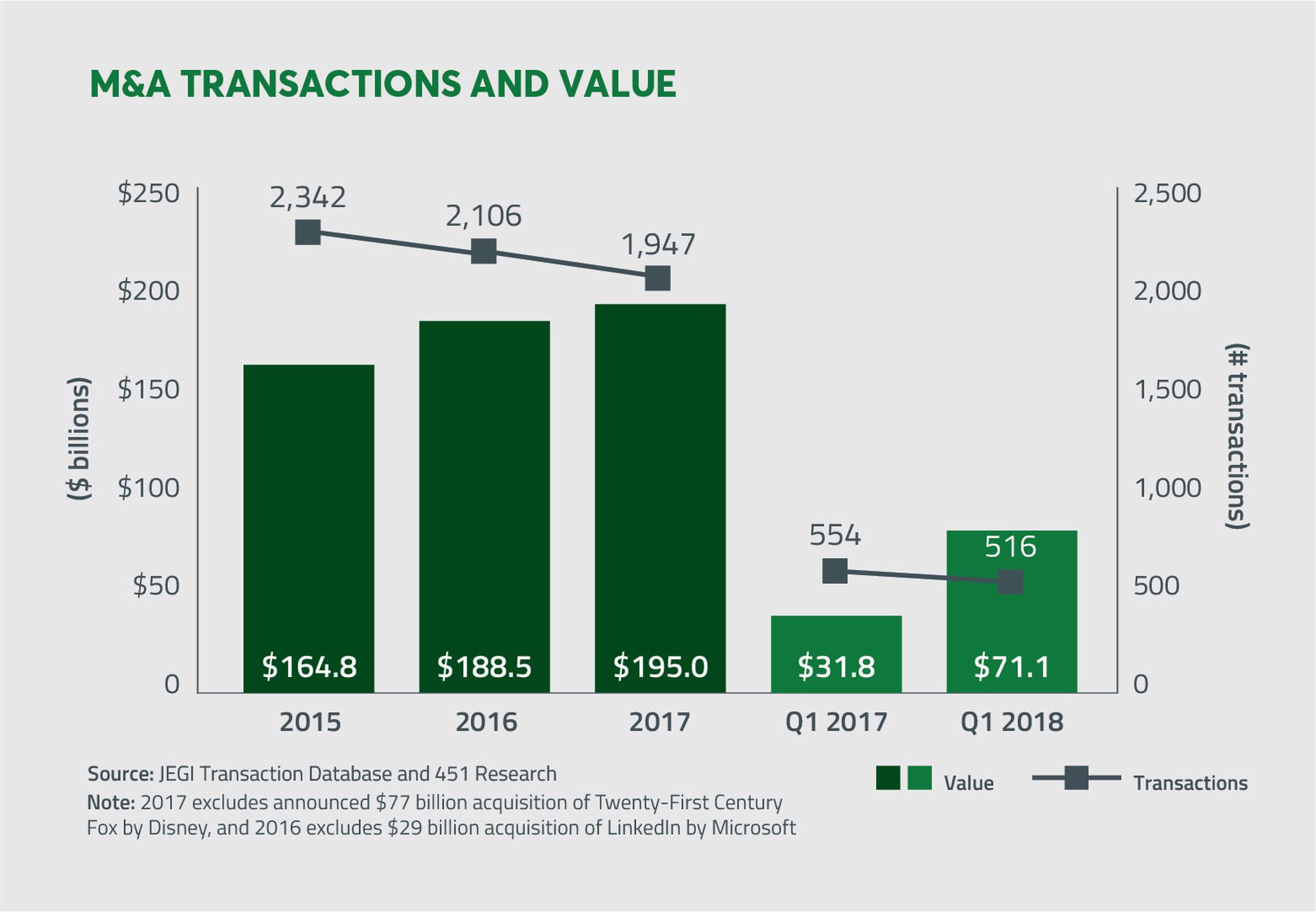

Merger and acquisition activity across the technology-enabled services market grew strongly in Q1 2018 vs. Q1 2017, according to a new Jegi Q1 M&A Overview.

The data stretches far beyond VARs, MSPs and CSPs -- offering a look at deal activity across media firms, technology solutions providers, software firms and more.

Mega deals certainly grabbed the spotlight. According to the report, tech-enabled services accounted for five transactions totaling $24 billion in value, or approximately 48%, of the $50 billion total, substantially more than any other sector reporting a megadeal. Total deal value (for all transactions) in the sector increased 207%, from $10.2 billion in Q1 2017 to $31.3 billion in Q1 2018. Deal volume in the sector stayed relatively flat quarter over quarter.

Of the remaining sectors in the report, Software was the only one that saw an increase in both deal volume and deal value.

M&A numbers in Q1 2018 by sector:

- B2B media and technology increased in deal value. Q1 was up 9% to $978 million from $899 million in Q1 2017. The overall number of deals, however, was down 31% from 26 in 2017 to 18 in 2018.

- Consumer media and technology decreased in deal value and number of transactions. In Q1 2017 the sector had 66 transactions with a value of $3.5 billion, whereas Q1 2018 saw 44 deals at $2.0 billion in value.

- Database and information services increased 163% to $11.7 billion in Q1 2018.

- Exhibitions and conferences saw an unprecedented increase of 1,320% in deal value, to $6.5 billion in 2018 from just $458 million in 2017

- Marketing services and technology sector continues to be very active, with 146 transactions accounting for $8.7 billion in deal value in Q1 2018. Deal volume decreased slightly, by 9% in 2018 versus the same period in 2017, but the sector saw an 85% increase in deal value.

- Mobile media and technology sector declined 59% in both deal volume and value in Q1 2018, to 16 transactions and $243 million in value, compared to 39 deals and $586 million in value in Q1 2017.

- Software saw an increase in both deal volume and deal value, up 32% to 146 transactions from 111 in 2017, and 38% to $9.7 billion in value from $7.0 billion in Q1 2017.

The astounding increase within the exhibition and conferences sector was largely driven by one deal in particular. The Informa acquisition of UBM for $6.3 billion was three times the value of all deals in the sector for all of 2017.

The report claims the economic outlook for 2018 points to favorable conditions for M&A throughout the remainder of the year. Consumer and business confidence levels remain strong, with The Conference Board Consumer Confidence Index standing at 127.7 in March.