M&A activity in the MSP (managed IT services provider) market remains steady to strong. And valuations remain high. But anecdotal evidence suggests that MSP valuations may have peaked somewhere in Q1 of 2022 and are now dipping a bit in Q2 of 2022, according to ChannelE2E.

Some big-picture anecdotes:

- The volume of overall mergers and acquisitions (extending far beyond the MSP market) is down from the brisk pace of 2021, The Wall Street Journal reported on May 23, 2022.

- Companies in the U.S. have struck $789.5 billion of mergers so far this year, down 31% from the same period in 2021, as market swings and broader economic uncertainty give many deal makers pause, The Journal said.

- IPO activity, meanwhile, has come to a virtual standstill as would-be public companies wait for calmer waters, The Journal concluded.

ChannelE2E's associated thesis: Falling valuations for publicly held SaaS and technology stocks -- couple with rising interest rates -- has inspired private equity firms to more closely scrutinize valuations for platforms (MSPs of scale) and tuck-ins (bolt-on MSPs).

MSP Valuations Based on Annual EBITDA Multiples: A Closer Look

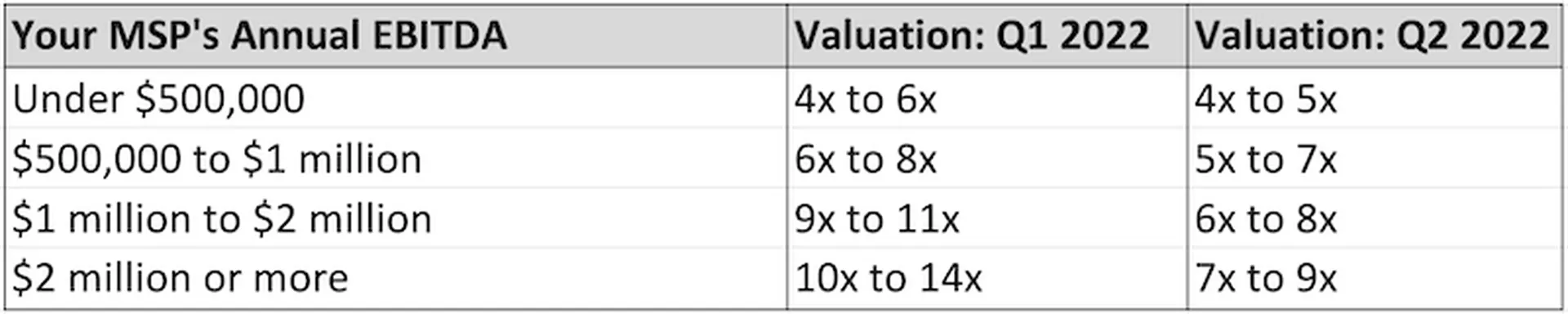

The MSP valuation chart below is based on two rounds of conversations between ChannelE2E and various MSP buyers.

- Round One - Q1 of 2022: ChannelE2E spoke on background with three well-placed sources. One source has been involved in 50+ M&A deals. The second source personally sold his midsize MSP, and now advises on M&A deals. The third source is CEO of a private equity-backed MSP that remains in acquisition mode. Based on those conversations, we pieced together some valuation multiples in the chart below.

- Round Two - Q2 of 2022: ChannelE2E heard again from one of the sources -- namely, the person involved in 50+ M&A deals. Based on that conversation, we revised estimated M&A valuations downward.

Here's the chart:

Admittedly, the chart above should be considered a general guide on MSP valuations -- since each M&A deal is unique and based on a range of variables. Moreover, a few sources suggest that MSP valuations are still at records (or setting new records) in Q2 of 2022.

And keep in mind: This is more than an EBITDA multiple discussion. You also need to understand and analyze your company's valuation based on revenue, gross profit margins, net income and year-over-year growth, according to Linda Rose, a former IT solutions provider owner/operator who sold three businesses and now operates RoseBiz, a boutique sell-side technology M&A advisory firm.

Also, keep in mind that our Q2 numbers involved an MSP buyer that's active in the market. And the buyer may want to slightly under-report valuations as part of ongoing negotiations with future acquisition targets.

MSP Acquisitions: M&A Deals So Far In 2022...

Meanwhile, keep in mind that MSP deal flow remains strong. Advisors like FOCUS Investment Banking remain plenty busy assisting on deals -- such as Lighthouse Technology Partners' recent company sale to Coretelligent. Other firms such as Cogent Growth Partners remain very active as well.

Bottom Line: ChannelE2E has tracked more than 500 M&A deals involving MSPs & technology firms from January 2022 through late May 2022. We have noticed a slight deal slow-down in recent days. We're also hearing from sources who are recalibrating their valuation models based on the recent Wall Street correction coupled with rising interest rates.

Overall, we suspect MSP valuations remain higher than historic norms -- but perhaps below the historic record highs we seemed to witness in Q1 of 2022.