Small Business Administration (SBA) loans known as the Paycheck Protection Program will become available on Friday, April 3 -- but the entire pool of money could be spoken for on the very first day, CNBC reported on April 1.

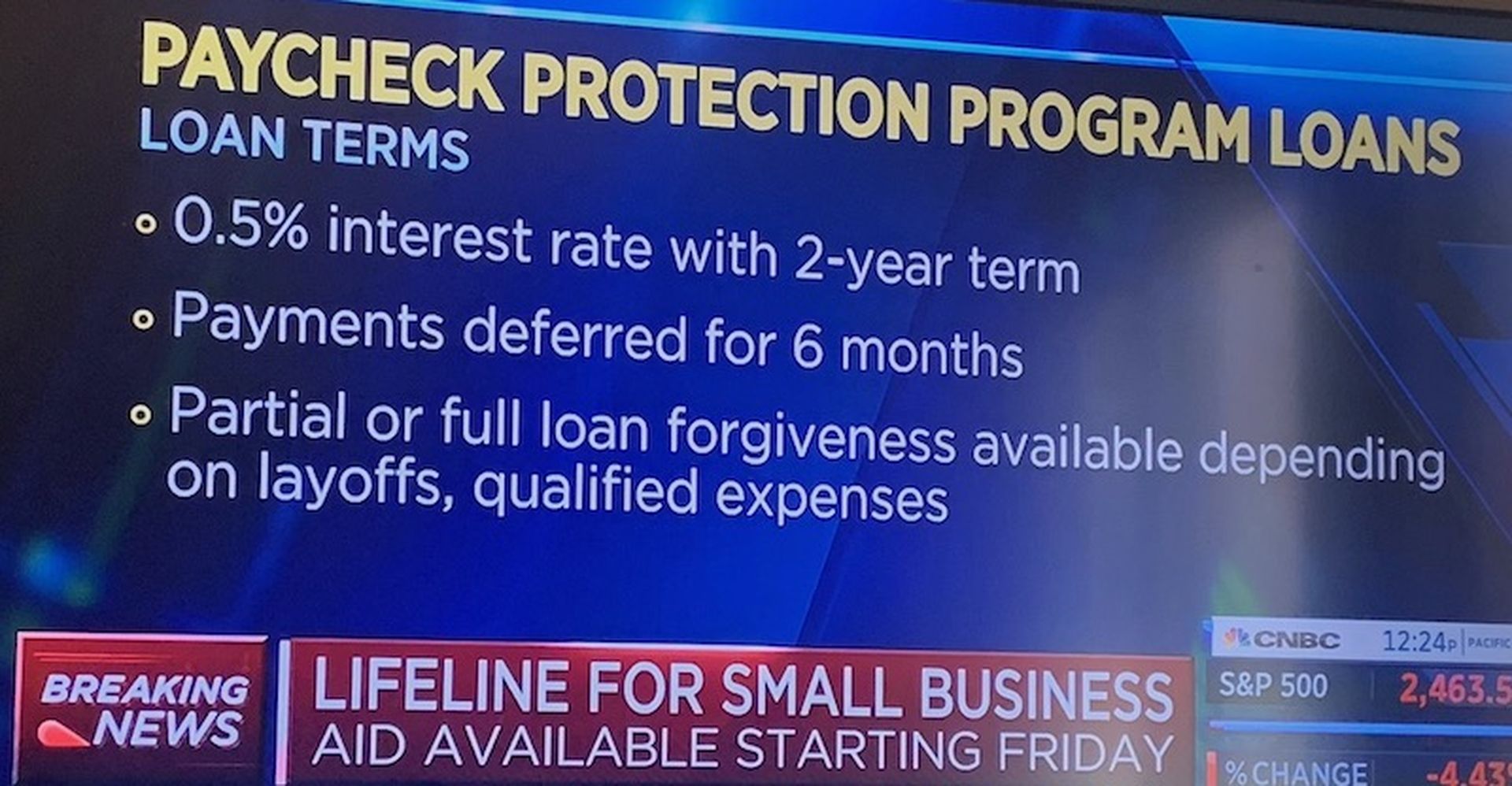

The loans are designed to help small businesses retain staff through the coronavirus pandemic. The big perk: The loans convert to grants -- which don't have to be repaid -- if the small businesses meet certain criteria.

Banks and lenders will begin to process those loans on April 3, based on a first-come, first-served basis. MSPs, channel partners and small businesses can apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating, the SBA says.

The SBA is telling small business to consult with your local lender as to whether it is participating in the program.

The initial Paycheck Protection Program pool of funds will likely run dry within one day to one week of launch, CNBC estimated. But the federal government has committed to taking a closer look at the program for additional funding once the first set of funds are spoken for.

The typical small business has two to four weeks of cash on hand, according to various financial services research reports. Without financial lifelines, somewhere between 20 percent and 30 percent of small businesses could shutter amid the U.S. economic shutdown, ChannelE2E has estimated based on CNBC, Wall Street Journal and other business reports.

Special: More Coronavirus Pandemic news, analysis and partner assistance programs.