Amazon Web Services (AWS) cloud revenues continue to surge and show no signs of slowing down. Indeed, AWS revenues were $5.442 billion in Q1 2018, up a stunning 48.6 percent from $3.661 billion in the corresponding quarter last year.

Equally impressive, AWS's operating income topped $1.4 billion -- up from $890 million in Q1 2o17.

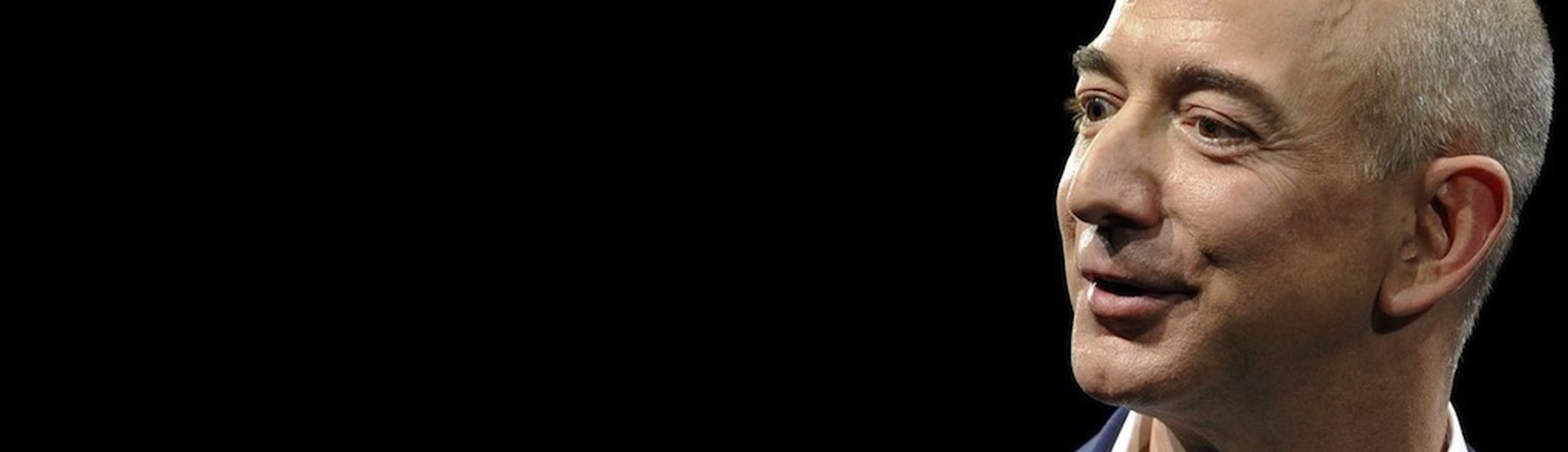

Amazon CEO Jeff Bezos credited several moves for the momentum. “AWS had the unusual advantage of a seven-year head start before facing like-minded competition, and the team has never slowed down,” he said. “As a result, the AWS services are by far the most evolved and most functionality-rich. AWS lets developers do more and be nimbler, and it continues to get even better every day. That’s why you’re seeing this remarkable acceleration in AWS growth, now for two quarters in a row. A huge thank you to all our AWS customers, and you can be sure we’ll keep working hard for you.”

AWS Attracts MSPs, Threatens Distributors

MSPs and private equity firms are taking note and making a land grab. Indeed, MSPs are racing to hire AWS-oriented talent, while private equity firms are looking to combine AWS-centric consulting firms with one another.

Earlier this week, Reliam acquired Stratalux, essentially merging two MSPs focused on AWS. Reliam parent Great Hill Partners, a private equity firm, funded the deal. And earlier today, Ensono, the hybrid IT services provider, said it now employees 100 experts who are certified within the AWS Partner Network (APN).

> Related Survey: Top 50 MSPs for Amazon Web Services/Top 50 MSPs for Azure

Meanwhile, the Amazon Web Services Marketplace has also emerged as a potential channel disrupter. The warning shot arrived in 2016, when Amazon launched SaaS billing — a quiet but strategic assault on traditional distribution, as ChannelE2E pointed out at the time. Fast forward to present day, and “The Amazon Effect” is coming to the channel, The 2112 Group recently warned.

AWS vs Microsoft, Google and IBM

Still, plenty of companies are giving chase -- with Microsoft widely considered Amazon's closest cloud rival. For its Q3 2018 results, also released today, Microsoft said:

- Azure revenue grew a stunning 93 percent.

- Office 365 commercial revenue grew 42 percent.

We're reviewing Microsoft's earnings call now to determine if the company offered specific revenue figures for its cloud businesses.

Earlier this week, Google largely avoided the cloud revenue discussion during the search giant's earning call. The company said last year that Google Cloud Platform was now generating more than $1 billion in quarterly revenues.

IBM also is giving chase, but also dances around specific quarterly revenue figures for SaaS. In its most recent quarter, IBM said total cloud revenue over the last 12 months was $17.7 billion, up 22 percent.